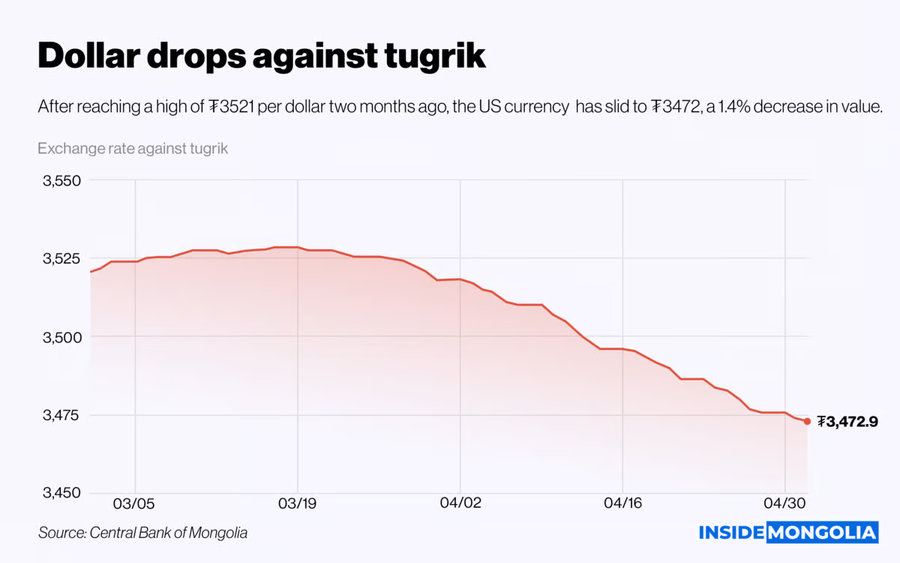

Tugrik rallies against dollar as a trade surplus and reserves rise

May 7, 2023

May 7, 2023

The Mongolian tugrik has gained 1.4% against the US dollar since March, reversing a sharp depreciation over the past year that alarmed consumers and policymakers.

The dollar had soared to a record high of $1 = ₮3,500 in January, eroding the purchasing power of Mongolians who rely on imports for many goods and services. But the tugrik has since bounced back, helped by a combination of factors. These include an increase in foreign currency reserves, a surge in exports, and the repayment of two government bonds that boosted investor confidence.

Monetary manoeuvres: Mongolia’s foreign currency reserves rose 11.6% to $3.7 billion in the past year, after commercial banks limited dollar-based transactions. The central bank also hiked its policy rate to 13% last December, up from 6% in January, to curb inflation and stem capital outflows. However, inflation surged to 12.1% this March, well above the central bank’s target of 6%.

Trade resurgence: Mongolia's trade balance improved significantly in the first quarter, as exports jumped 96% and imports rose 14.7% compared to last year. The trade surplus widened to $1.8 billion, up from $228 million a year ago.

- The country's main export is coal, which accounts for about 40% of its total shipments. Coal prices have rebounded from a slump last year, driven by strong demand from China, Mongolia's largest trading partner.

Fiscal responsibility: Mongolia has recently repaid the last installments of two sovereign bonds, totalling $531 million. The Chinggis bond, issued in 2012, was fully paid off last December, while the Gerege bond, issued in 2017, was settled this May. The bond repayments enhanced Mongolia's creditworthiness and reduced its debt burden.

External factors: However, the tugrik's appreciation was also partly due to the dollar's weakness in global markets. The US currency has fallen 9.7% since reaching a five-year high of $112.1 in September last year, as measured by the US dollar index. The dollar has faced competition from other currencies, such as the Chinese yuan and digital currencies, which have gained popularity for international trade and payments.

While a stronger tugrik benefits Mongolian consumers by lowering import costs, the government faces the challenge of maintaining exchange rate stability and avoiding excessive volatility that could hurt domestic producers, exporters, and foreign investors.

Comment