All green: TOP-5 Banks

Khulan M.

November 4, 2024

November 4, 2024

The long-awaited Q3 earnings report from the Trade Development Bank (TDB) wraps up the TOP-5 banks’ earnings picture. Let’s play Sherlock Holmes on it.

👏 Thank you for the color, TOP-5!

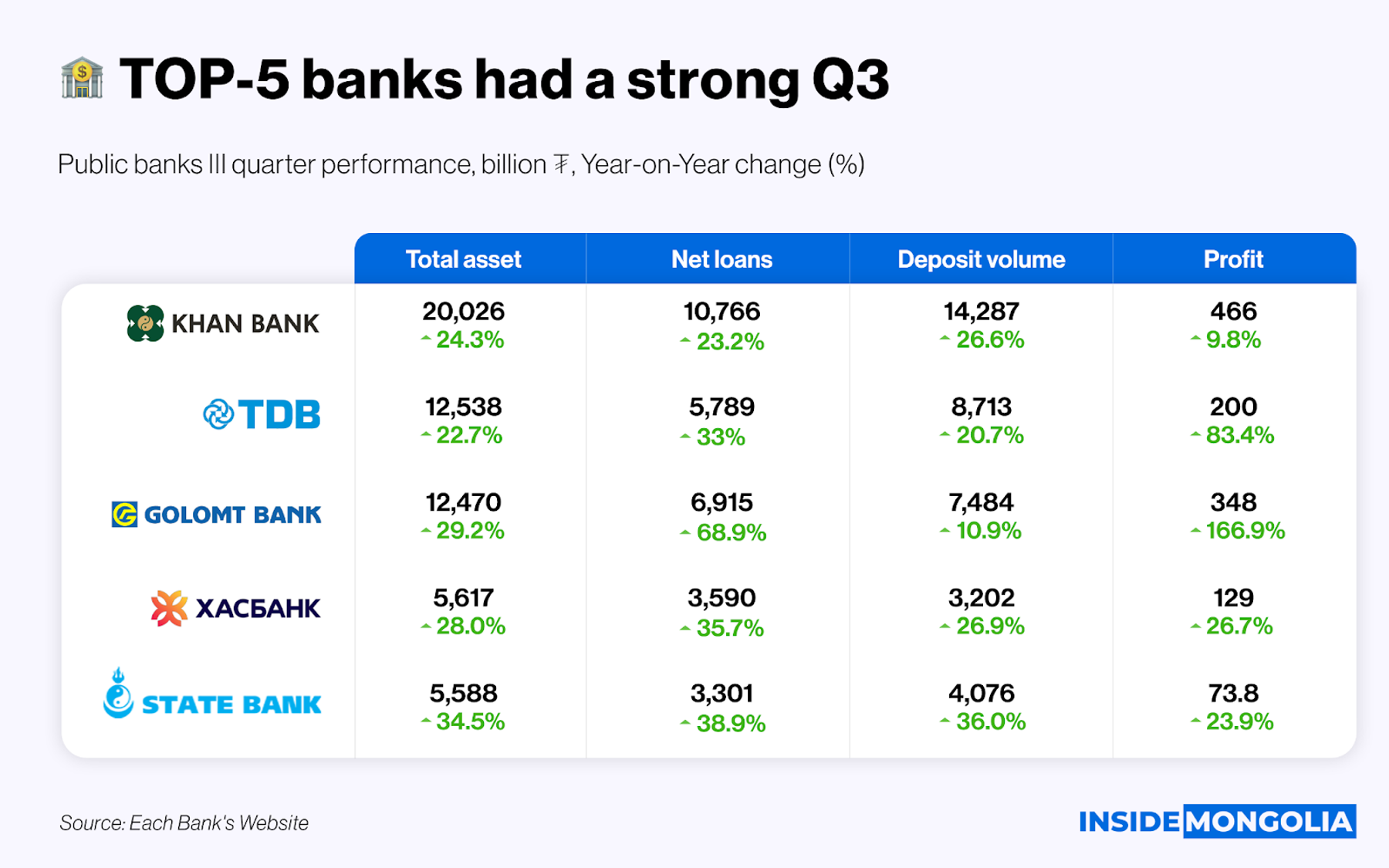

All 5 systemically important banks deliver a green-hued Q3, with total net profits reaching ₮1.2 trillion. Together, they boost net profits by ₮391 billion year-on-year, and total assets, net loans, current accounts, and deposits all saw gains. In short, it’s a feast, but not everyone is eating the same slice.

🥊 Small But Mighty

The 5 public banks manage a combined ₮56 trillion in assets in Q3. The State Bank of Mongolia (SBM), with the smallest asset base, leads in asset growth with an impressive 34.5% increase, followed by XacBank (XAC) at 28%. TDB, despite its larger asset base, sees a more modest increase of 22.7%.

- Highest 🆚 Lowest: Golomt Bank (GLMT) has the highest net profit growth, though Khan Bank (KHAN) maintains its lead in absolute net profit, albeit with the lowest growth rate. Khan Bank’s ROE stands at 28.3%, 2 percentage points above the TOP-20 index average.

📈 ₮113.5 Billion Growth

Turning to the market stage, the combined market cap of the 6 public banks, adding Bogd Bank (BOGD), rises by ₮113.5 billion over the past year, now totaling ₮5.4 trillion and representing 43.7% of the total market cap.

- 🌥️ Not All Sunshine: Golomt Bank and XacBank adds ₮393.2 billion to their market cap, while the other 4 banks collectively lost ₮279.7 billion. Khan Bank leads the losses, down ₮147.2 billion, with TDB following close behind at ₮122.5 billion.

👁️ Behind TDB’s Historic Profits

TDB finally drops its Q3 report, and it’s juicy. Net profit skyrockets 83.4% year-on-year to over ₮200 billion, thanks to a 50.9% jump in interest income, while expenses climb only 28%. That leaves TDB with a hefty ₮166.6 billion margin on interest income. Net loans rise 33% to ₮5.8 billion, and deposits grow 20.7% to ₮8.7 billion. But let’s not get carried away, while TDB is putting up solid numbers, it’s still playing a little below the league average, with asset growth 5 percentage points short of the TOP-5 average.

- From 1 to 0.4: Non-performing loans fall from over ₮1 billion to ₮432 billion, though they still account for 7.5% of TDB’s total net loans, a higher-than-average figure in the sector.

🤔 Slow Recovery on the Stock Front

On the stock side, TDB’s shares have been a bit sluggish. The stock hit a high of ₮35,500 last June, only to drift back to its IPO price of ₮33,000 by year-end. As of last Friday, it’s sitting at ₮24,500, a 34.7% drop from its peak, dragging TDB’s market cap down by ₮445 billion since January. TDB’s numbers are fine, but to investors, it’s a tough sell right now.

Ok, this is the end of the overview of how Mongolian banks are doing in Q3. What do you think?

Comment