Closing the Books: Mongolian Stock Market Year-End Review

Khulan M.

December 27, 2024

December 27, 2024

Marking our second year-end review, Inside Mongolia delves into the stock market’s key highlights for 2024. From soaring indices to shifting sector dynamics, here’s a comprehensive look at this year’s performance.

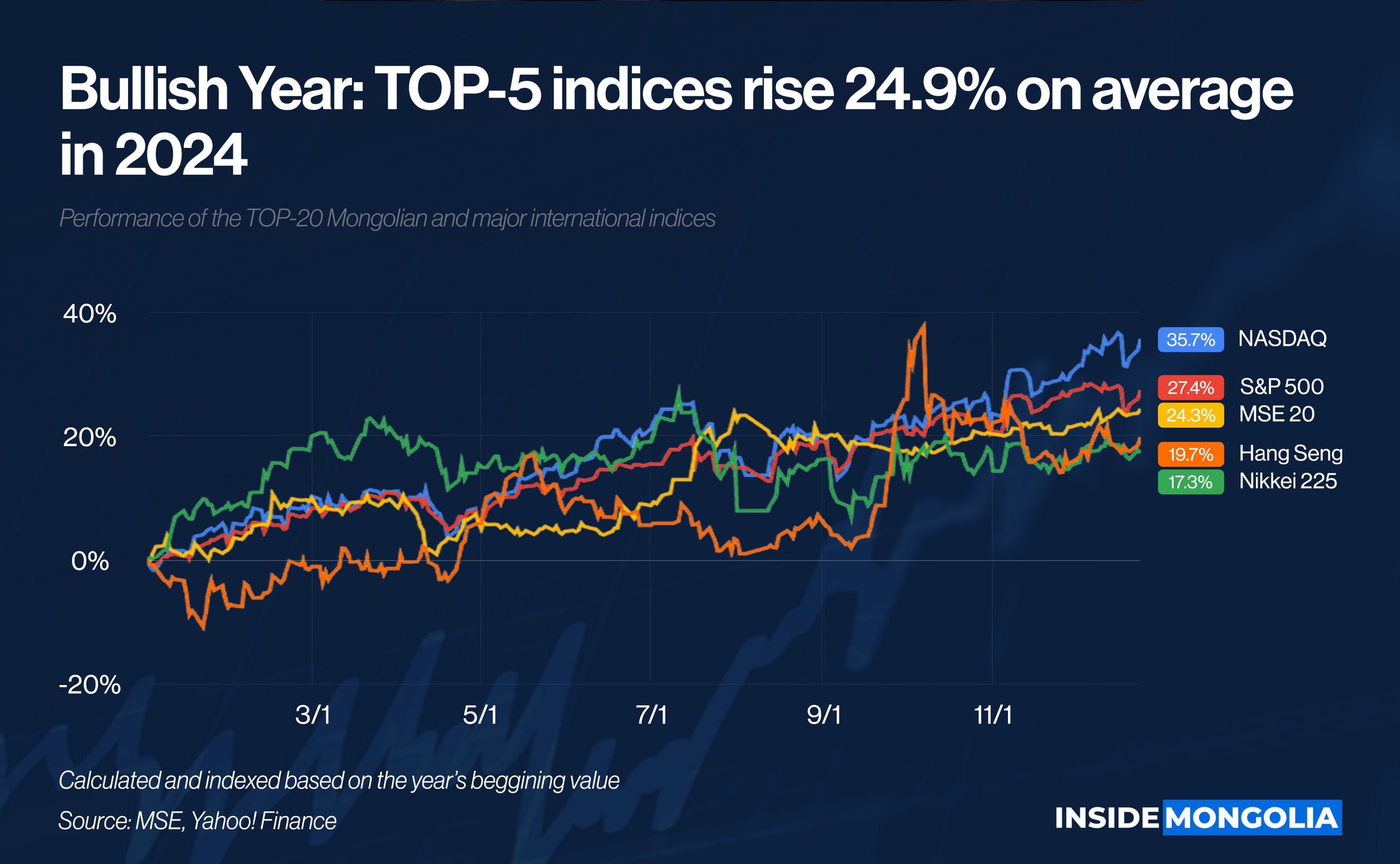

📈 A Bullish Year for Markets

The MSE TOP-20 Index, alongside major global indices, delivers impressive gains in 2024. The NASDAQ (^IXIC) climbs 35.7% year-to-date, driven by the outstanding performance of technology giants. Similarly, the S&P 500 (^GSPC) rises 27.4%, reflecting strong investments in artificial intelligence, e-commerce, and cloud technology. This bullish trend is further supported by the U.S. Federal Reserve’s decision to cut interest rates three times during the year.

- 🗺️ Regional Highlights: Turning to Asia, the Nikkei 225 (^N225) advances 17.3%, fueled by Japan’s robust export growth and structural reforms in the electrical and automotive industries. Meanwhile, the Hang Seng (^HSI) index surges 19.7%, as pro-investment measures from China’s government boost market confidence.

- Closer to home, Mongolia’s TOP-20 Index shows a remarkable 24.3% increase, primarily driven by the banking and mining sectors. By December 2024, the Mongolian Stock Exchange (MSE) records a 10.9% rise in total market capitalization, reaching ₮12.8 trillion.

📊 Movers and Shakers

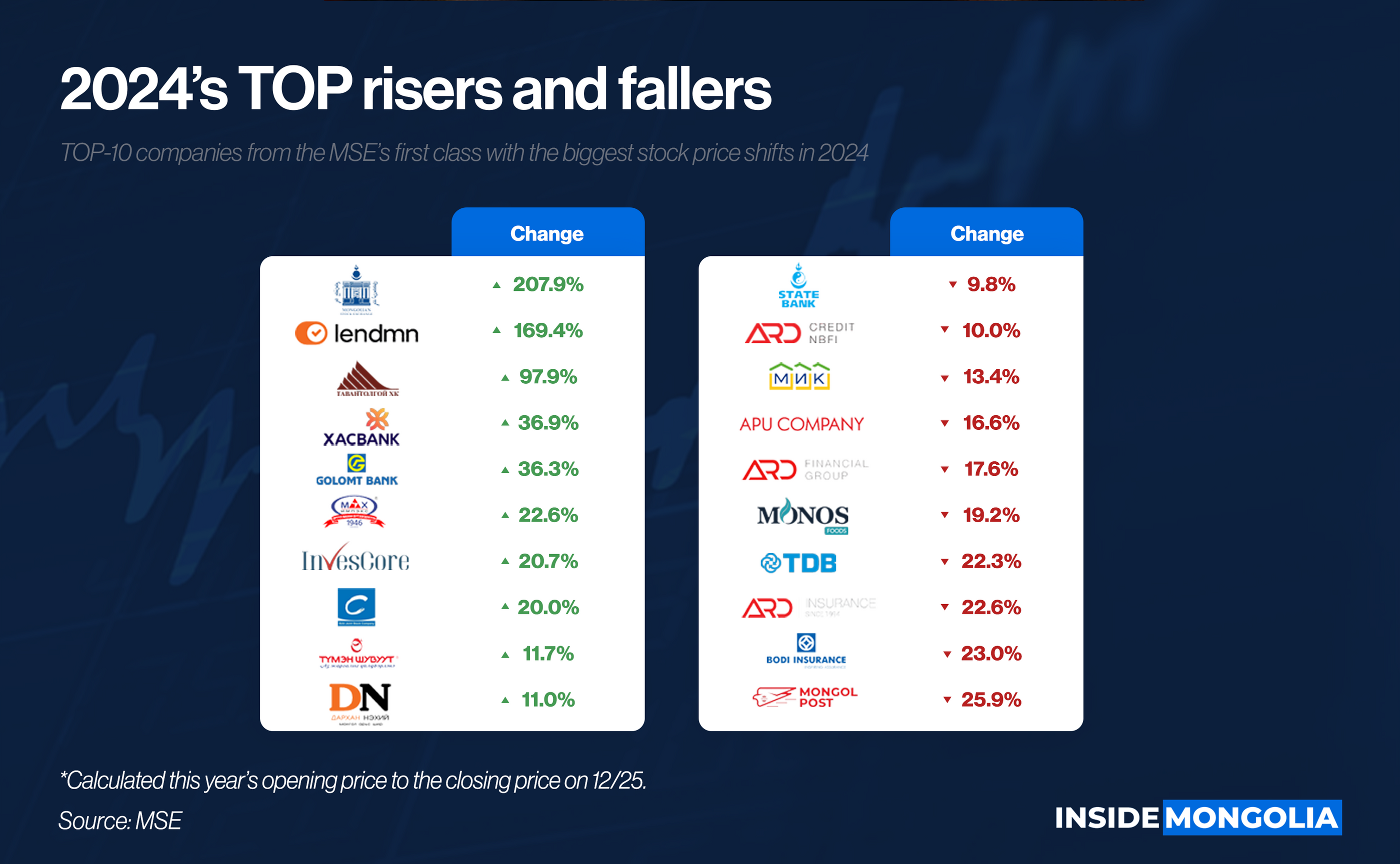

The MSE’s First-Class stock showcases notable gains, with the TOP-10 performers including 2 non-bank financial institutions, 2 banks, and a mining company. This underscores the continued strength of Mongolia’s banking and finance sectors.

- 🏦 Banking Leadership: According to Ashid Asset Management’s Capital Market Outlook 2025, publicly traded banks account for ₮65.7 billion (24.4%) of the total ₮269 billion traded on the MSE as of November.

- 😋 Food Sector Growth: Shares in 3 major food companies also perform strongly, averaging a 17.5% increase. Makh Impex (MMX) leads the group with a 20.7% rise.

Conversely, Ard Financial Group (AARD) and 3 of its affiliates emerge as some of the year’s largest decliners. Additionally, $TDB shares fail to exceed their IPO price. APU (APU), Mongolia’s “Blue Chip,” records a 16.6% drop, largely due to a significant employee share issuance.

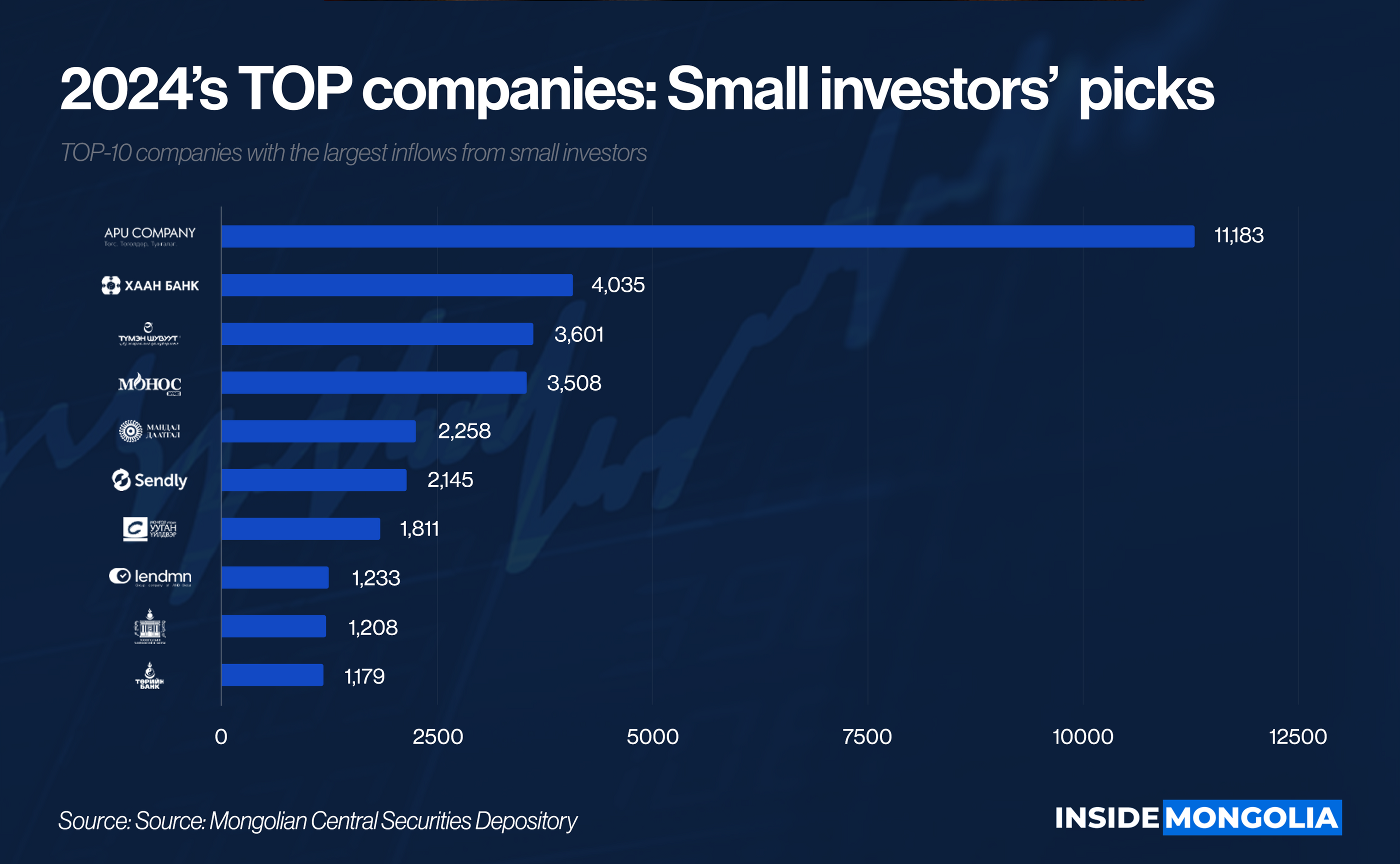

🏦 Shareholder Activity

The number of small shareholders in TOP-20 companies continues to grow in 2024. However, active trading remains concentrated among approximately 30 of the 172 listed companies on the MSE. The food, banking, and finance sectors dominate this activity. Experts recommend implementing regulatory measures to enhance market participation and delist non-compliant entities to improve market efficiency.

🆕 IPOs and Bonds

Mongolia sees only 2 IPOs in 2024, MGL Aqua (MGLA) and Tenger Daatgal (TGI), which collectively raise ₮25.2 billion. By December, $MGLA shares are up 5.2% from their IPO price, while $TGI shares experience a slight dip of 2.6%.

- 🖨️ Bond Issuance: The bond market experiences significant activity in 2024, with 6 issues raising ₮190 billion and $36 million. These include 3 green bonds and a social-green bond, with notable first-time issuances from KhanBank (KHAN) and TML Plastic.

- 📈 OTC Market Resurgence: Over-the-counter (OTC) trading gathers momentum in the second half of the year. The State Bank (SBM) successfully places a ₮10 billion green bond via OTC, contributing to October’s record-breaking OTC securities value of ₮2.2 trillion.

🌈 Trading Activity in Mongolia

Data from the Mongolian Securities Clearing Center shows that 44,826 investors participate in stock trading during the first 4 months of the year. Among them, only 14 are foreign legal entities, and 313 are foreign investors. This trend continues into November, with foreign investors and legal entities contributing just 1.7% of the total stock trading value.

- 🔻 A Declining Trend: Stock trading trends from 2018 to 2023, as reviewed by Ashid Asset Management, reveal a sharp decline in the participation of foreign enterprises and investors since 2020. Addressing this issue requires attracting foreign investment across various sectors and increasing their presence in the market. To achieve this, Mongolia needs to improve its legal framework, create a favorable trading environment, and enhance liquidity.

In summary, boosting foreign portfolio investment strengthens liquidity and raises market value. Focusing on foreign investors and addressing their needs remains a priority for the upcoming year. Progress in this area is essential, and 2025 offers an opportunity to make it happen.

Comment