Bank of Mongolia Ends 5-Year Losses with 2024 Profit

Khulan M.

May 19, 2025

May 19, 2025

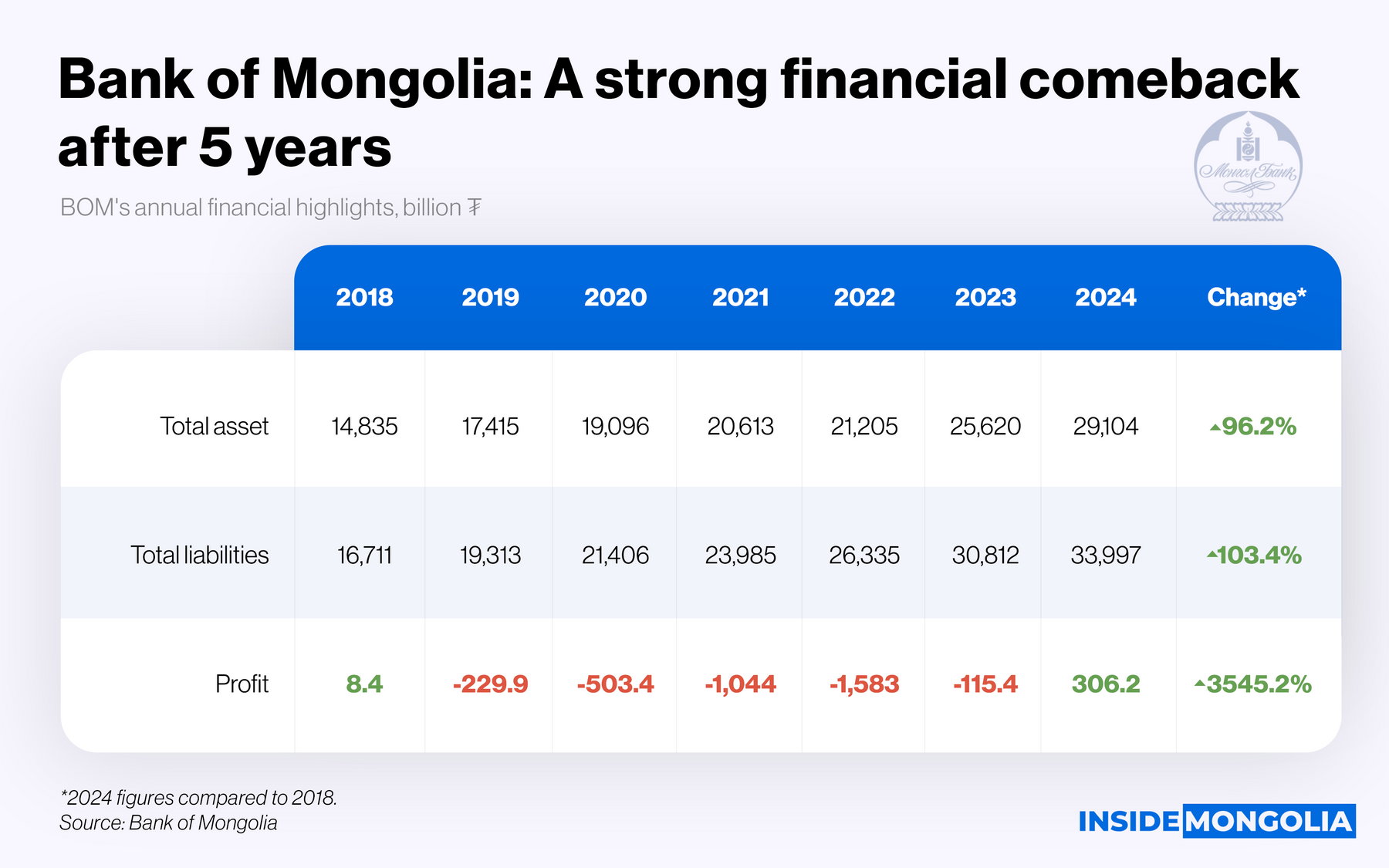

Since 2017, the Bank of Mongolia’s total assets have surged by 150.4%. Yet, despite this significant growth, the central bank experienced consecutive annual losses between 2019 and 2023, totaling ₮3.4 trillion. In 2024, however, it marked a financial turnaround, reporting a net profit of ₮306.2 billion, its first return to profitability in 5 years.

🤔 Why Does Profit Matter?

Although the Bank of Mongolia is not mandated to operate for profit, maintaining profitability carries broader significance. It contributes to economic stability, strengthens public finances, and enhances the country’s international credibility. By law, the central bank must allocate at least 40% of its annual net income to the General Reserve Fund and can contribute up to 60% to the state budget, further reinforcing its role in supporting fiscal resilience.

- 🤲🏻 What Drives Profitability? Several factors influence the Bank of Mongolia’s profitability, including returns on foreign exchange reserves, interest income from loans extended to commercial banks, inflation trends, and policy costs tied to maintaining exchange rate stability.

- 🌠 Notably, during the 2019–2023 loss-making period, the policy interest rate remained relatively low, dipping to 6% at one point. While lower rates generally reduce borrowing costs and could support profitability, the prolonged losses during this period raise questions about underlying financial pressures.

- 💰 External Debt: On the external debt front, the Bank has been gradually reducing its liabilities since the fourth quarter of 2021. However, a significant repayment of $1 billion still looms ahead.

📜 Key Takeaways from the Report

The bank successfully reversed a multi-year loss trend. It continues to fulfill its core mandates, price stability, ₮ exchange rate management, and banking sector oversight. In 2024, interbank transaction volumes increased by 45% year-over-year, surpassing the ₮1 quadrillion mark.

Bottom Line… After 5 years of losses, the Bank of Mongolia is back in the black. Looking ahead, the key challenge will be to control inflation and maintain currency stability without triggering new economic imbalances.

Comment