Economic Highlights of 2024: The Highs, Lows, and What’s Next?

Khulan M.

December 31, 2024

December 31, 2024

Happy New Year to all our dear Inside Mongolia readers! As our final wrap-up of the year, we’re bringing you an A-to-Z overview of Mongolia’s economy in 2024.

📃 Brief and Clear

Mongolia’s economy grows by 5% in 2022 and 7.4% in 2023, with a 5% increase in the third quarter of this year. This growth is driven by a 25% rise in the physical volume of mining raw materials, particularly coal exports. The related sectors expand, and economic activity picks up from the second half of the year. Household consumption also increases due to wage and pension hikes, and government spending grows significantly, further boosting economic activity.

To further stimulate the economy, the Bank of Mongolia lowers its policy interest rate to 10%, aiming to support medium-term growth, encourage lending, and increase consumption. This move leads to a 33.4% rise in lending, totaling ₮8.7 trillion compared to last year.

🔢 2024 GDP Figures

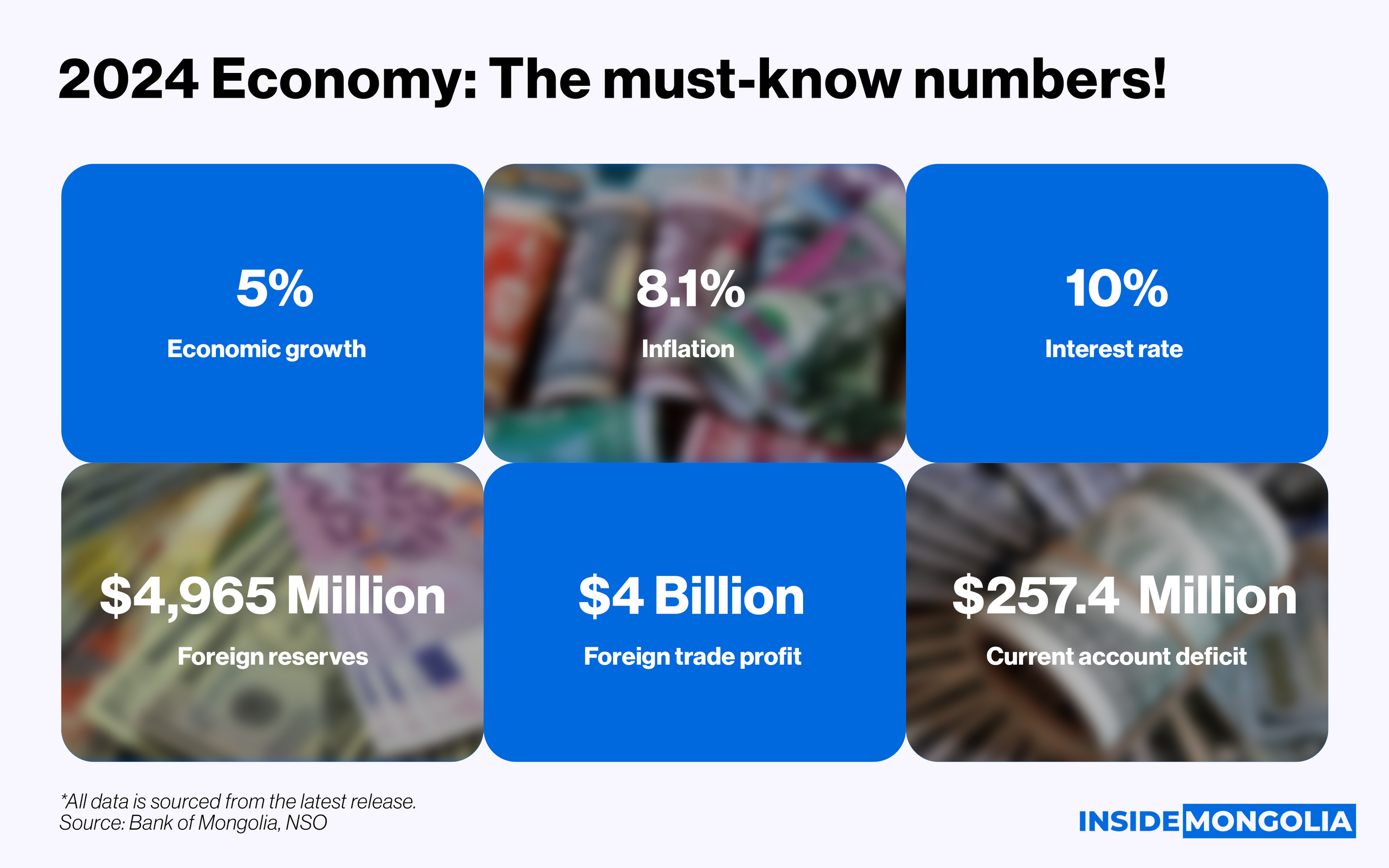

Here are a few key numbers reflecting this year’s economic outlook,

- 10%: The Bank of Mongolia raises the policy rate 5 times in 2022 to 13%, but since March, they lower the rate to 10%, stimulating lending. Inflation, previously maintained at the target level, now stands at 8.1%.

- 0.3%: The MNT exchange rate remains relatively stable over the past 2 years due to rising export revenues and GDP growth. However, since the beginning of this year, MNT weakens by 0.3% against the US dollar, now at $1=₮3,420.

- 0.88%: Foreign exchange reserves exceed $5.2 billion in March when the policy rate drops but decrease to $4.96 billion due to foreign debt and bond repayments, resulting in a net annual increase of only 0.88%.

- ₮2.024 million: As of November, the average salary increases by 30.1%, or ₮467.9 thousand, from the previous year to ₮2.024 million. Median salaries grow by 23.4% or ₮470.3 thousand to ₮2.479 million, reducing the salary gap to ₮455 thousand.

- ₮792 thousand: In 2025, the minimum wage increases by 20% or ₮132 thousand to ₮792 thousand. This marks the first time in history that the minimum wage is revised for 3 consecutive years.

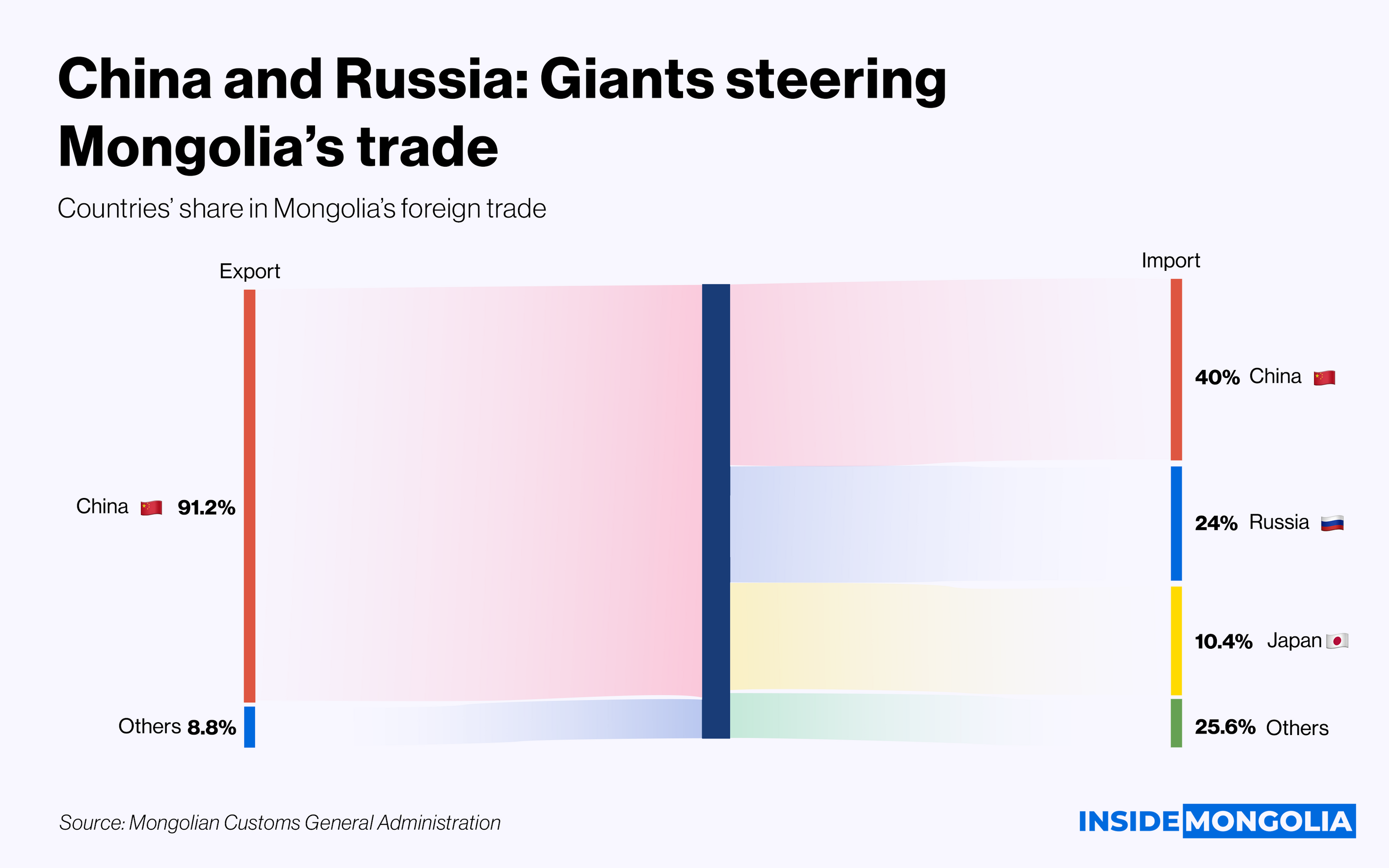

🇨🇳🇷🇺 Neighborhood Relations: Dependence

This year marks a notable expansion in Mongolia’s foreign relations, highlighted by visits from the Presidents of 12 countries and 1 international organization. However, despite these diplomatic advances, Mongolia’s trade dependency on its two largest neighbors, China and Russia, continues to deepen. As of November, 91.2% of total exports flow to China, while 64% of imports originate from China and Russia.

This reliance underscores the urgent need for economic diversification. At present, coal accounts for the majority of exports to China, while nearly all exports to Switzerland consist of gold. Broadening Mongolia’s export base to include value-added products and reaching more markets will be key to strengthening the structure and competitiveness of its foreign trade.

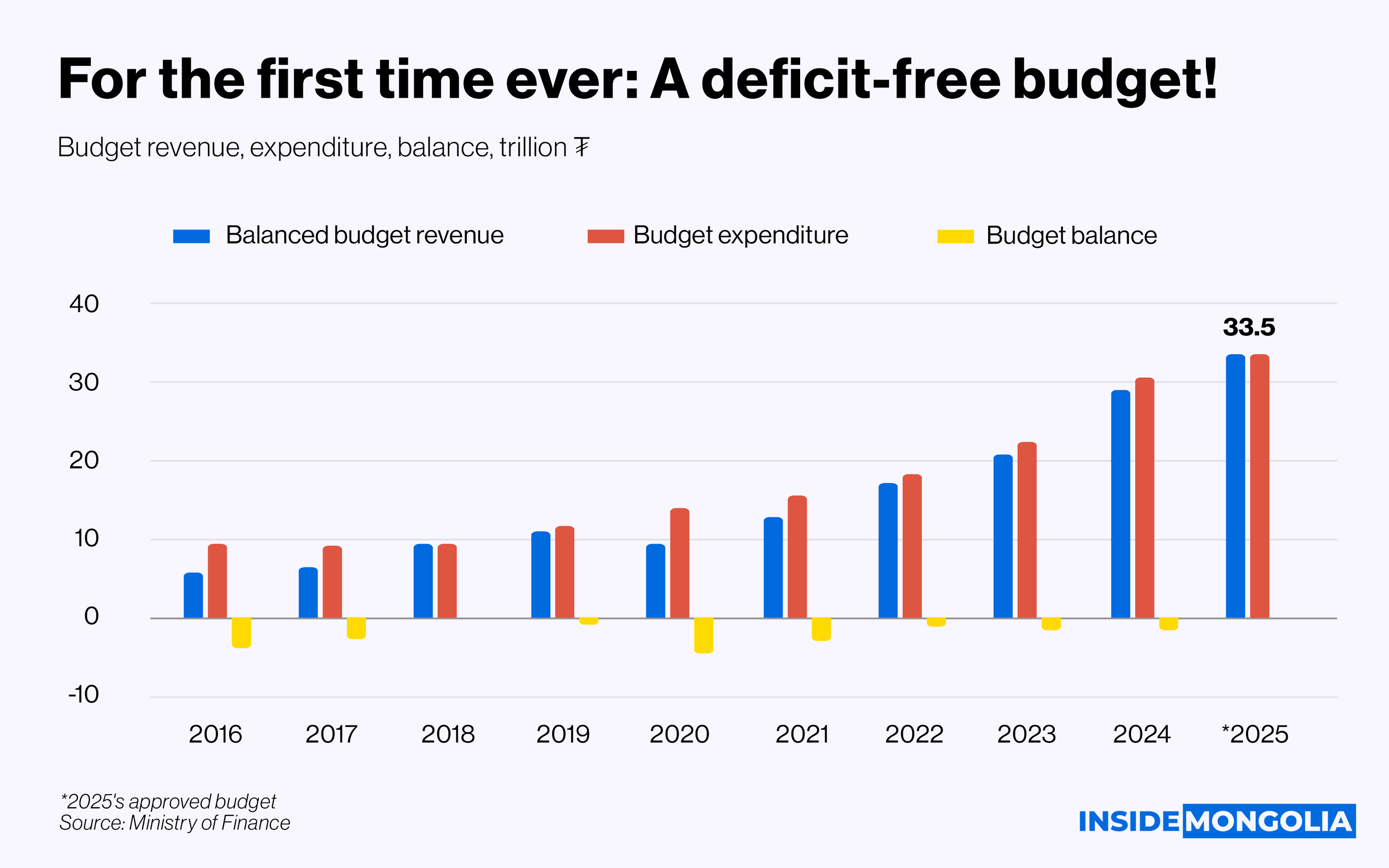

✨ A Special Year

Mongolia’s budget has been in deficit every year except 2018. Although next year’s budget initially includes a deficit, the President vetoes it, leading to a revised balanced budget with a 3.5% GDP surplus.

One noteworthy aspect of the revised budget is the allocation of cuts. Although the budget is reduced by ₮2.3 trillion, the areas and items targeted for these cuts raise some questions. For instance, while significant reductions include limiting the recruitment of new civil servants, items such as a cheese factory and other seemingly less critical expenditures remain intact.

- Moreover, the total budget for the Prime Minister and 16 ministries is cut by ₮1.8 trillion, resulting in notable losses. Among the ministries, the most substantial reduction is applied to the Ministry of Road Transport Development, which faces a 33% cut. Similarly, the Ministry of Industry and Mineral Resources—ranked second among revenue-generating ministries—sees its budget reduced by 31%. In contrast, the Prime Minister’s budget experiences a significant 43% increase.

While the approval of a deficit-free budget is commendable, ensuring its effective implementation and performance will be essential for achieving its intended outcomes.

💰 External Debt: $36 Billion

As of Q3, Mongolia’s total external debt rises by 7.2% year-on-year to $35.6 billion. Savings institutions’ external debt shows the highest increase, at 23.1%.

The government repays major bonds, such as Gerege, Samurai, and Chinggis, issuing new ones to cover $800 million and $600 million repayments. This genius strategy leaves us with 3 delightful bonds maturing between 2026 and 2029, racking up a princely $1.6 billion in principal payments. Oh, and let’s not forget the average 7.2% interest rate. The real challenge, however, lies in the Government's impeccable ability to spend and control these funds. Fingers crossed, right?

- On the city front, the Capital joins the bond parade by issuing 2 of its own. One for ₮500 billion and another for $500 million. For the ₮500 billion bond, a solid 60% is earmarked for the Buuruljuult power plant, while the remaining 40% generously goes towards upgrading roads, the Tuul collector, and flood dams. As for the $500 million bond? Every last cent goes into building the Selbe substation. Let’s hope this grand investment spree finally pays off because optimism never hurts anyone.

📈 Looking Ahead: 7.2% Growth in 2025

In 2025, the Mongolian economy is expected to grow by 2 percentage points more than in 2024—a bright forecast of 7.2% average growth, according to influential organizations. The Ministry of Finance leads the optimism with an 8% prediction, while the ADB takes a more cautious stance at 6%. Somewhere in between, we cross our fingers for the sweet spot.

Finally, it wouldn’t be a new year without a fresh lineup of challenges. Energy and fuel supply issues? Check. Falling commodity prices? Naturally. Rising import costs? Why not! These hurdles remind us that sustainable growth isn’t a given—it requires real effort. Long-term solutions, such as investing in infrastructure, diversifying production, and rebalancing foreign trade, are essential. Because, let’s be honest, relying on luck alone isn’t a growth strategy.

Comment