Capital Market Fairy Tale

Khulan M.

November 3, 2025

November 3, 2025

Since the start of the year, no company has launched an IPO, while some existing public companies have either shut down or paused operations, even profitable ones. As a result, both market value and trading activity have weakened significantly.

- To revive the dormant market, the government has turned to internal securities issuance. The sleeping princess is the capital market, and the prince is the government bond.

💋 ₮60 Billion Lifeline

The government is attempting to revive Mongolia’s dormant capital market through primary trading of government securities. Last Wednesday, the instruments, with a ₮100,000 nominal value and discounted coupon, began trading. Monthly turnover is projected at ₮20 billion, totaling ₮60 billion per quarter. While the move signals the government’s commitment, experts caution that this alone may not be enough to jumpstart a market that has been largely inactive for months.

🧐 Market Reality

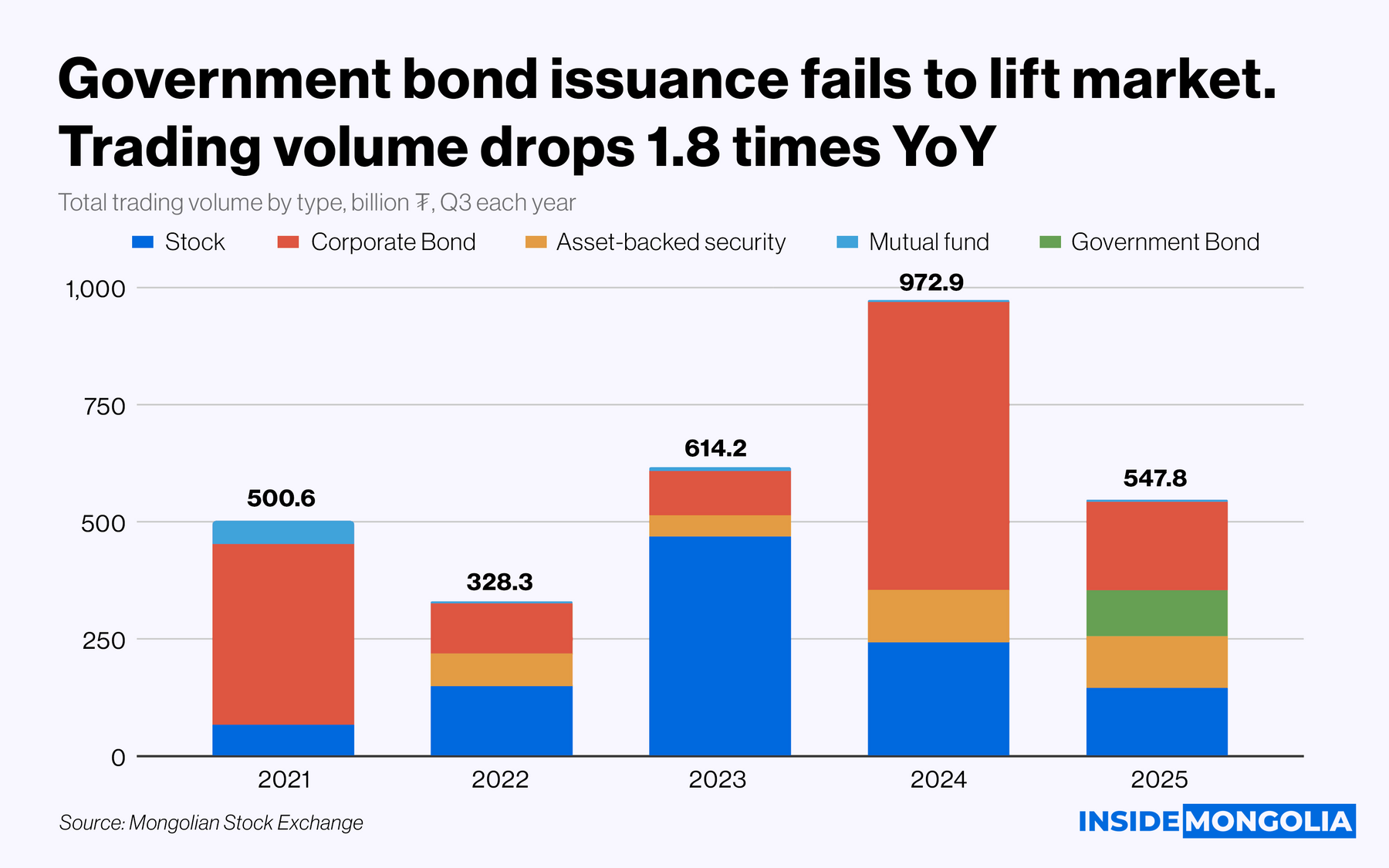

Despite the launch of government securities, overall market activity remains subdued. For the first 9 months of 2025, total trading volume fell by ₮425 billion, representing a 1.8 times decline compared to the same period last year. Stock trading suffered even more sharply, down 3.2 times from 2023 levels, highlighting the persistent lack of liquidity and investor confidence. Even though ₮97 billion in government bonds have been traded so far, the market revival remains limited, suggesting that structural challenges, such as inactive listings and the absence of new IPOs, are constraining growth.

📌 Corporate Challenges

Furthermore, no new public companies have listed this year, while some existing firms have exited. Notably, Govi (GOV), which operated at a loss for 6 years, faced regulatory scrutiny when its transaction with Goyo LLC was deemed illegal, impacting 25,000 small shareholders.

Overall… The market clearly needs better investor protection, stronger supervision, and incentives to reactivate frozen listings. A single government bond is unlikely to revive the market unless structural issues are addressed and confidence is restored.

Comment