Insurance premium revenue grew by 36.2% to reach ₮169.2 billion

Angirmaa

August 21, 2023

August 21, 2023

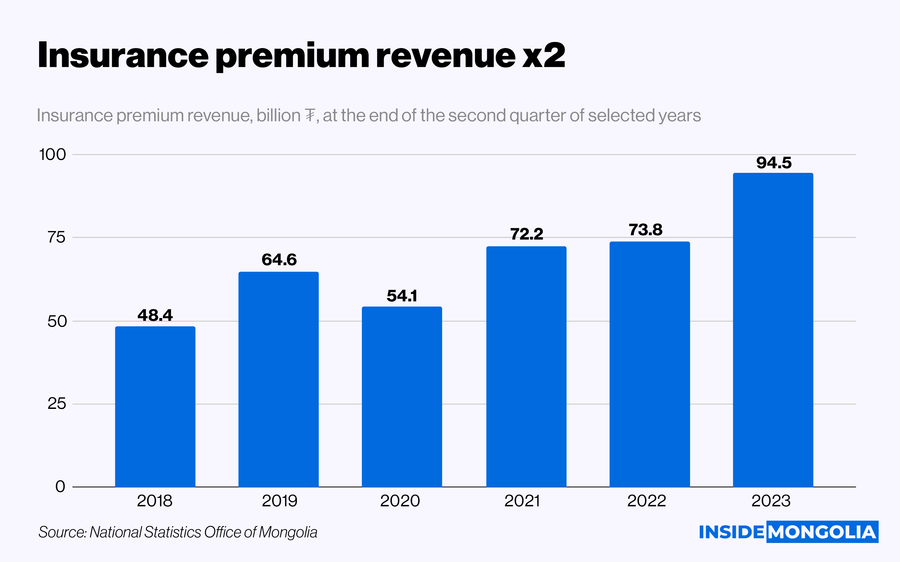

Insurance premium revenue during the first half of 2023 surged by an impressive 36.2% compared to the corresponding period last year, reaching a substantial ₮169.2 billion. Here's a breakdown of the key components,

- Insured People: The number of insured persons reached 883.2 thousand. Compulsory insurance accounts for 51.3% of all insured persons while voluntary insurance accounts for 48.5%, and long-term or life insurance accounts for 0.2%.

- Income Structure: 25.7% of total insurance premium revenue comes from vehicle insurance while property insurance revenue accounts for 15.1%.

- Impact: The growth in total insurance premium income primarily attributes to a notable 45.6% surge in vehicle insurance premium revenue and a substantial 46.3% uptick in property insurance premium revenue.

- Settlement: Moreover, insurance settlement also witnessed an increase of 10.3%, reaching a sum of ₮53.4 billion. The vehicle insurance settlement rose by 41.3%, while settlement for accident and medical insurance experienced a growth of 25.4%.

Industry Representation

Taking a closer look at some of the insurance companies registered on the MSE (MSE) as industry representatives,

- Ard Insurance (AIC): The company's profit for the first half surged by a remarkable 2.1 times, reaching ₮646.1 million. This positive growth can be attributed to a substantial 23.4% increase in net income from insurance premiums.

- Mongol Daatgal (MDIC): Conversely, MDIC encountered a loss of ₮2 billion during the first half of the year. This can be attributed to the company's profitability in terms of insurance operations, overshadowed by elevated general, sales, and marketing expenses.

- Bodi Insurance (BODI): While the company registered a profit of ₮305.8 million, it faced a loss of ₮1.2 billion in the same period this year. The decrease in income coupled with increased compensation amounts played a role in this shift.

- Mandal Daatgal (MNDL): On the other hand, MNDL achieved the highest profit of ₮1.7 billion. However, this represents a 24.8% decrease compared to the corresponding period last year.

In conclusion, the insurance industry in Mongolia appears to be expanding year by year, with a growing cultural adoption of insurance practices. The dynamic nature of this sector underscores the varied financial performance of different insurance companies.

Comment