Trading Volume Plummets

The latest report on securities firms’ trading activity on the Mongolian Stock Exchange (MSE) reveals a sharp 63% drop in total trading volume compared to the first half of last year.

🧐 What Caused the Slowdown?

Primary market activity slowed considerably this year. Unlike last year, there were no IPOs, and the issuance of new bonds and asset-backed securities on the MSE declined sharply. A major factor was the absence of large bond issuances similar to last year’s ₮500 billion Ulaanbaatar bond, which was traded in 3 tranches and boosted overall volume.

- This year, although domestic government securities are actively traded, their monthly volumes are roughly 25 times lower than the previous Ulaanbaatar bonds. Consequently, securities firms’ trading activity in the primary market plummeted by 90.9%, declining by ₮1.1 trillion.

🔍 Is Investor Interest in Stocks Waning?

While the secondary market experienced increased trading in corporate bonds and asset-backed securities, trading volumes for stocks and mutual funds fell by 29.6% or ₮96.7 billion. This decline has slowed the trend of stock price appreciation, negatively impacting company valuations across the board.

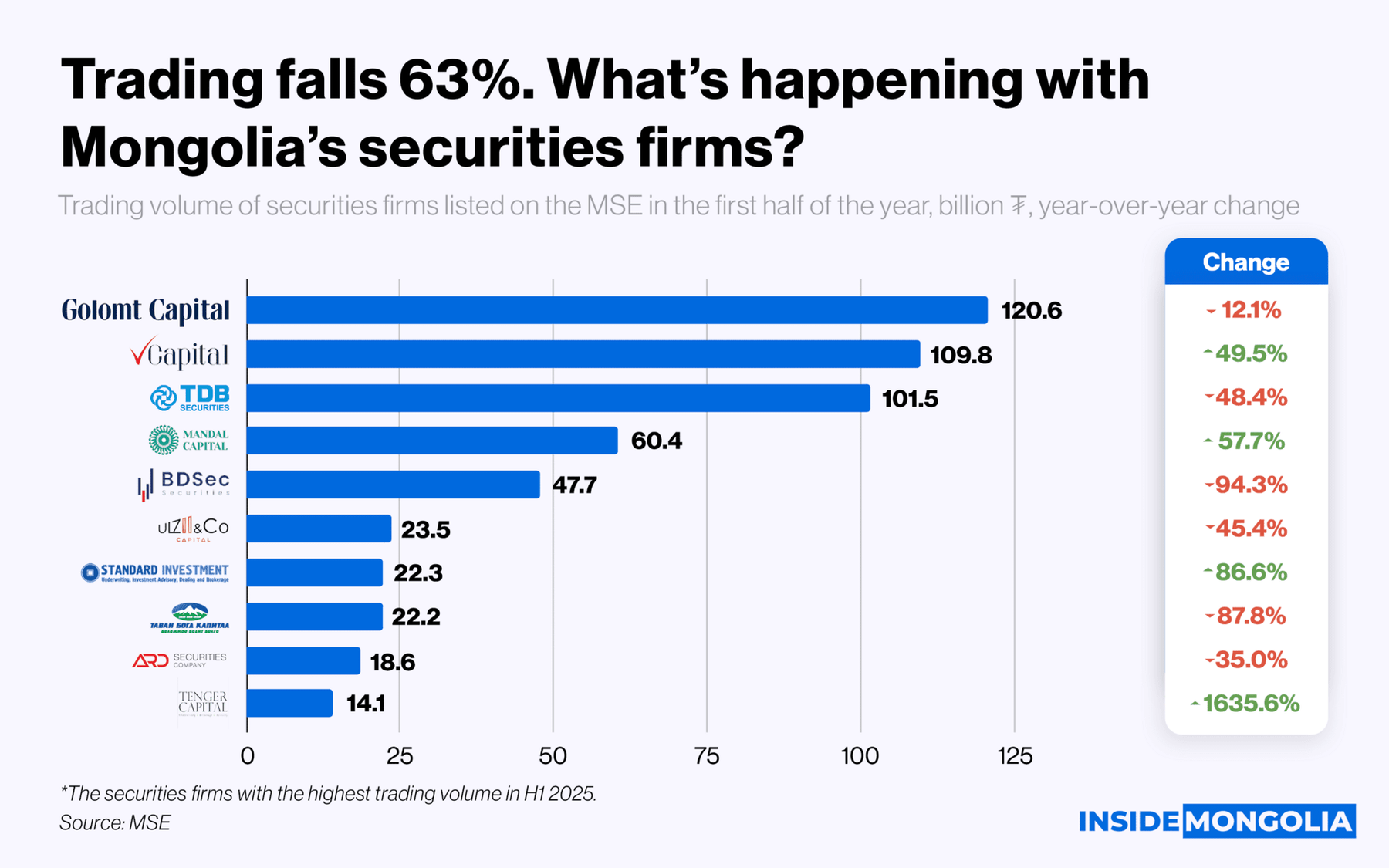

🔢 Shifting Company Rankings

Furthermore, the list of the most actively trading securities firms on the exchange has changed drastically. Last year, BDSec (BDS) dominated as the lead underwriter of Ulaanbaatar bonds, controlling 52.5% of total trading volume. However, this year, $BDS’s stock volume plunged by 94.3%, pushing it down to 5th place. Despite this, Golomt Capital has taken the lead, with a relatively modest 12.1% drop in trading volume but commanding 20.4% of total activity.

- 🚀 Tenger Capital’s Meteoric Rise: While 6 of the top 10 securities firms saw their trading volumes decline, Tenger Capital surged an astonishing 1,635.6%, vaulting from 21st place last year to 10th, highlighting pockets of strong investor interest.

Finally… After a period of rapid growth, Mongolia’s stock market appears to be slipping into a lull once again. Market liquidity and trading activity are weakening, signaling the urgent need for fresh incentives and reforms to restore investor confidence and invigorate the market.

Comment