Wage Growth & Inflation in Mongolia

Khulan M.

March 24, 2025

March 24, 2025

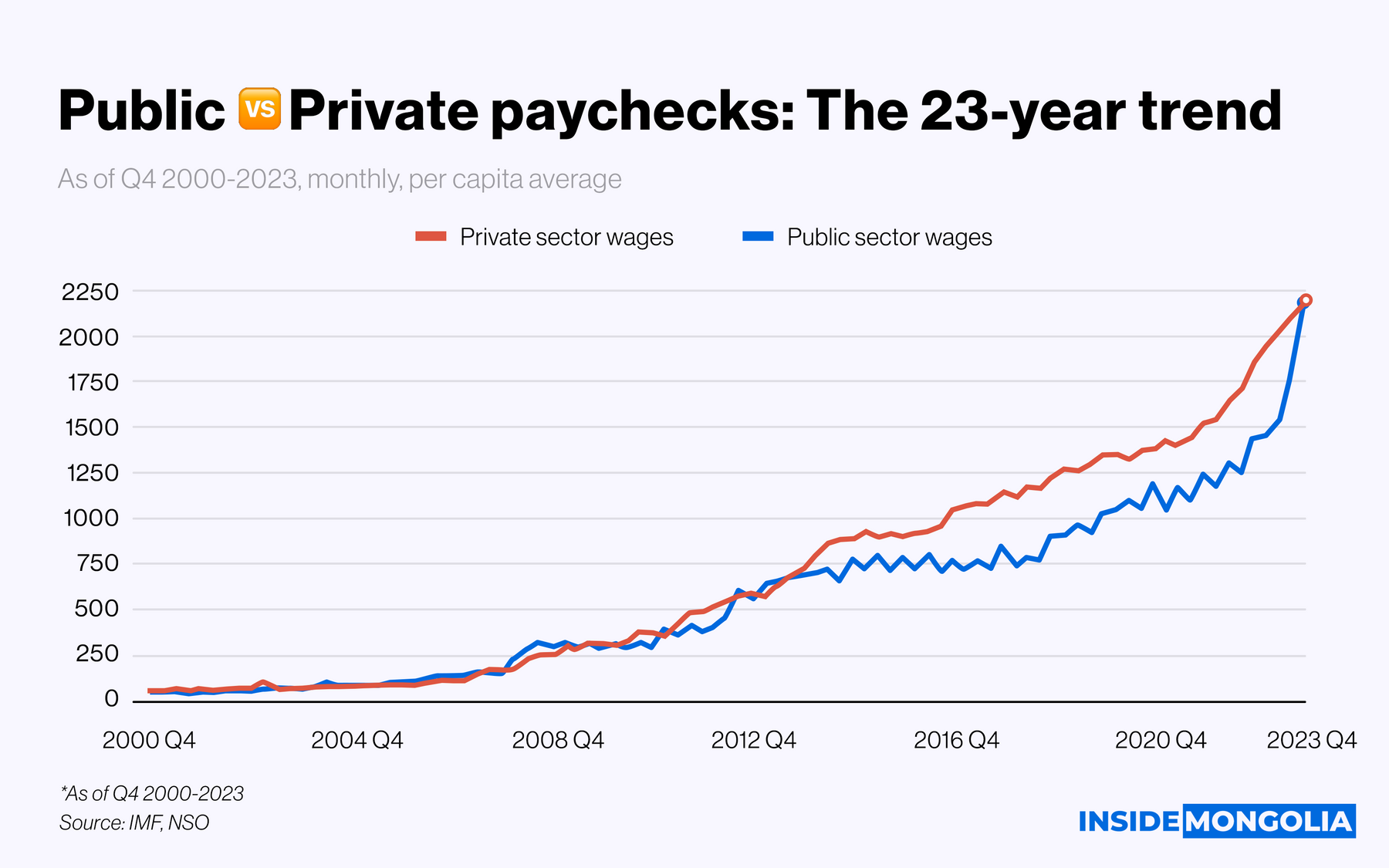

A recent IMF study, examining over 2 decades of wage trends from Q4 2000 to Q4 2023, reveals a key driver of inflation. Does rising pay in the public or private sector fuel price surges more? The findings may challenge common assumptions.

- Wage Growth vs. Inflation: Between 2001 and 2022, real wage growth in both sectors exceeds inflation. Public sector wages grow by an average of 15%, private sector wages by 16%, while inflation averages 8%. This wage growth, outpacing inflation, adds to inflationary pressures.

🙄 Private Sector Wage Growth and Immediate Inflation Impact

The IMF study finds that private-sector wage increases have a stronger and more immediate impact on inflation than public-sector wage hikes. Both sectors have an elasticity of 0.6, meaning a 10% wage increase leads to a 6% rise in inflation. However, public-sector wage hikes take longer to affect inflation, with the impact peaking in 2025.

- 🔙 From 2000 to 2010, public and private sector wages in Mongolia generally move together. However, from 2011 onwards, private-sector wages start to outpace public-sector wages, partly due to increased foreign direct investment (FDI), particularly in the Oyu Tolgoi mine.

In 2023, public wages rise by an average of 35%—20 percentage points higher than the historical 15% annual growth. This sharp increase adds 13 percentage points to inflation by mid-2025, though pressures gradually ease after 2026.

🤔 Why the Private Sector Leads Wage Growth

Private sector wages, especially in high-paying industries like mining, set wage trends. Despite employing just 5% of the workforce, the mining sector offers the highest wages, driven by FDI and economic demand. From 2011 to 2023, private-sector wages consistently outpace public-sector wages, maintaining a 30% wage premium by 2023. However, the 2023 public sector wage hike eliminates this premium within two quarters.

- 💥 As private sector wages rise, the public sector often follows suit to remain competitive, making public-sector wage growth largely reactive.

Finally… The IMF recommends aligning public wage growth with productivity. However, low wages and low productivity reinforce each other, creating a cycle that calls for structural reform.

Comment