Spotlight on Mongolia: A Glimpse into Stocks, Banks, Economy, and Diplomacy

Khulan M.

July 25, 2024

July 25, 2024

Heads up! Expats in Mongolia and Mongolia enthusiasts! Here's a deep dive into what's been happening in Mongolia during the first half of 2024, covering the stock market, banking sector, economy, and foreign relations.

👀 DIPLOMACY: On the rise

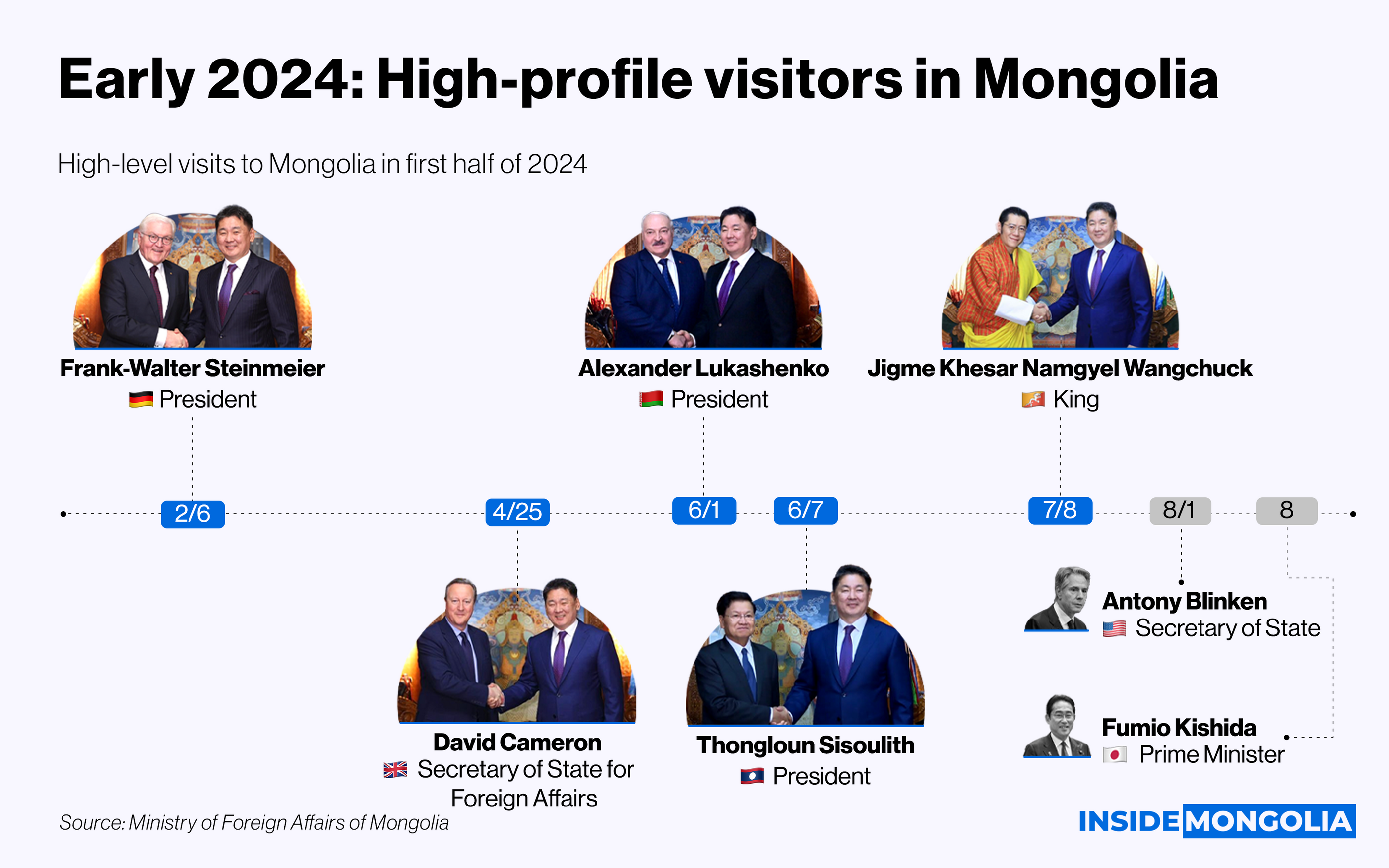

So far the half of 2024, Mongolia welcomes 5 high-profile heads of countries.

🛬 Landed

The President of Germany breaks the wind of the New Year's visit. As a result, Germany and Mongolia upgrade their partnership to a strategic partnership, and Germany becomes Mongolia's first strategic partner among European countries.

Furthermore, after 11 years late Secretary of Foreign, Commonwealth, and Development Affairs David Cameron visits Mongolia for the first time. Before the election, the Presidents of Belarus and Laos arrive in Mongolia 4 days apart.

🛫 Took off

Even though the historical Parliamentary elections limit outbound visits, President Khurelsukh.U pays a visit to Uzbekistan, following his participation in the Shanghai Cooperation Organizations (SCO) summit in Kazakstan. Afterward, the newly reappointed Minister of Foreign Affairs Mrs.Battsetseg.B visits the U.S. So far, from the Mongolian side, we have 2 high-level visits in H1 of 2024.

🔜 Coming soon

At the invitation of the Foreign Affairs Minister, on August 1st Secretary of State Antony Blinken set to visit Mongolia. Furthermore, Japanese Prime Minister Kishida Fumio and the President of Slovenia are also expected to visit Mongolia next August. About Kishida Fumio, he is going to visit Mongolia for the first time since he was appointed as the Prime Minister of Japan.

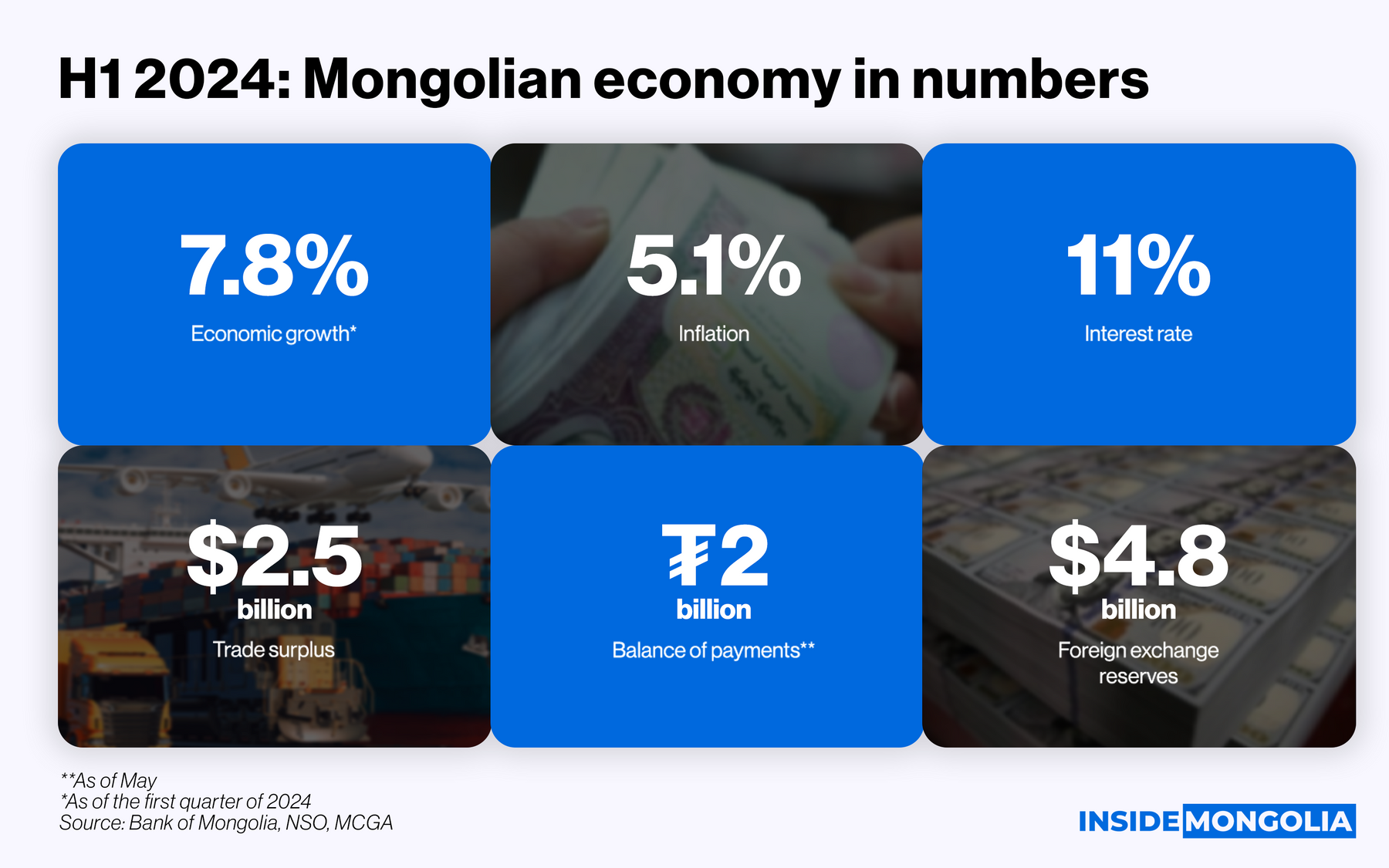

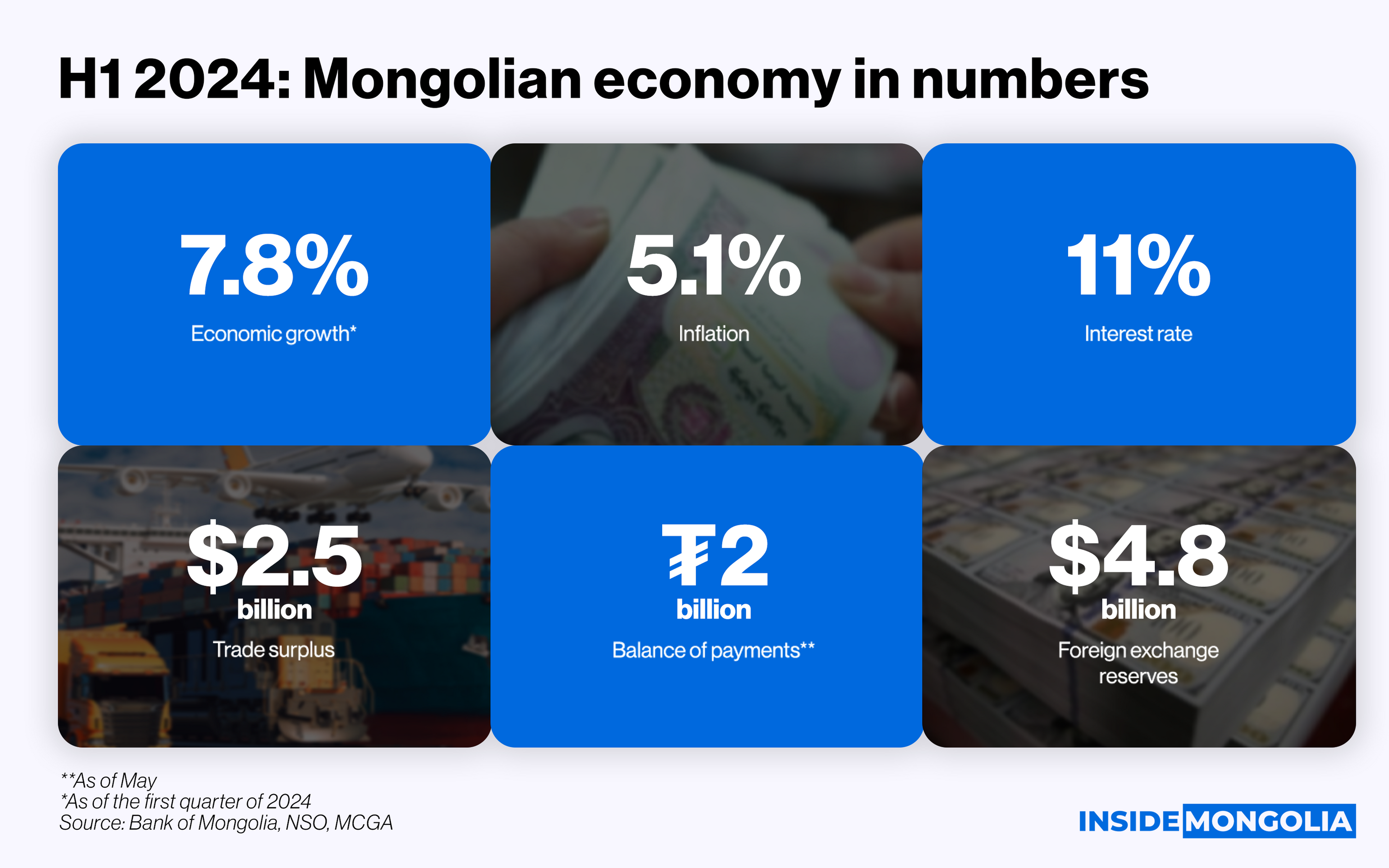

📝 ECONOMY: Taming Inflation, Lowering Rates

National inflation, a major concern at the end of the first half of 2023 (10.6%), has been brought under control. By June 2024, it settled comfortably at 5.1%, aligning with the Bank of Mongolia's target. This translates to a significant 5.5 percentage point decrease compared to the previous year.

The Bank of Mongolia actively contributed to this positive shift. Policy interest rates, which had been steady at 13% since December 2022, were reduced twice in a row, reaching 11%. This move is expected to stimulate economic growth. However, there are discrepancies in growth projections. The World Bank has revised Mongolia's economic growth forecast downwards by 1.4 percentage points to 4.8% for 2024.

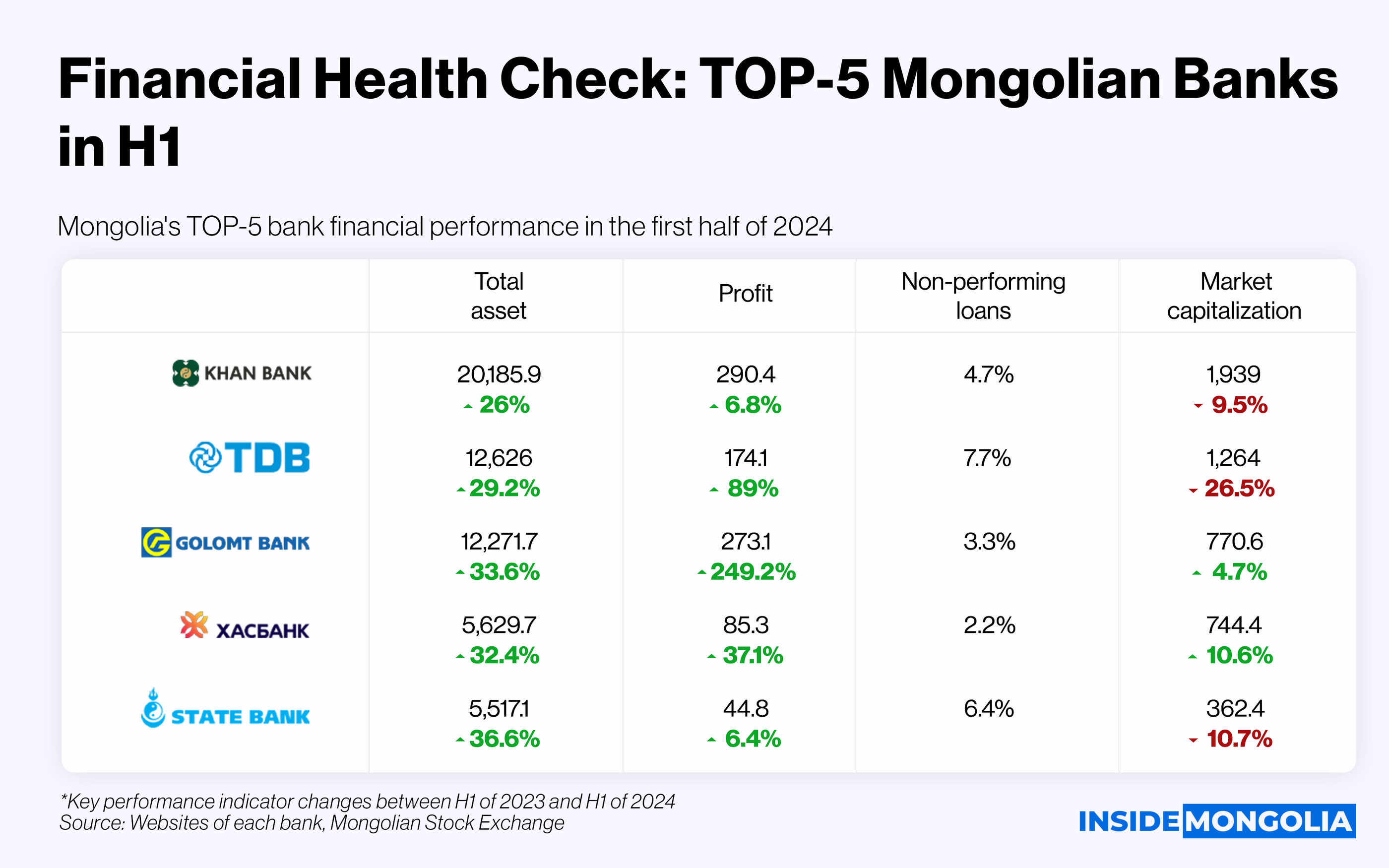

🆙 BANKING: TOP-5 Is Topping

Moving on to the financial performance of Mongolia's top 5 public banks, the first half of 2024 witnesses a remarkable 58.7% increase in profits compared to the same period last year, reaching a combined ₮867.7 billion.

Total assets for these banks also see a substantial rise, increasing by 30% to ₮43.3 trillion compared to a year ago. Current and deposit accounts grow by 28.9%, while loans grant increased by 33.1%, contributing to a ₮321.1 billion rise in overall profitability.

🚀 GLMT: Skyrocketing

Among the systemically important banks, Golomt Bank (GLMT) stands out with a stellar profit increase of 249.2%, reaching ₮273.1 billion. This impressive figure constitutes 31.5% of the total profit for the top five banks combined. This growth is attributed to a surge in both loans and non-interest income. As a result, GLMT's share price climbed by 11.8% to ₮1,190 as of July 22nd.

🔎 SBM: Contrasting Fortunes

State Bank (SBM) presents a contrasting picture. While it boasts the highest growth in total assets, its profit increase is the least impressive. Additionally, an analysis of profit per employee across the TOP-5 banks reveals Golomt Bank at the top and State Bank at the bottom.

🤝 Loan Quality Improves

Furthermore, there's positive news on non-performing loans (NPLs). The share of NPLs in the total net loans of these banks decreases by an average of 1.1 percentage points compared to the first quarter. Trade and Development Bank (TDB) still holds the highest NPL ratio at 1.8 percentage points, although it has improved. XacBank (XAC), on the other hand, emerges as the leader with the lowest NPL ratio of 2.2%.

🐣 CAPITAL MARKET: Retail Investors Shift

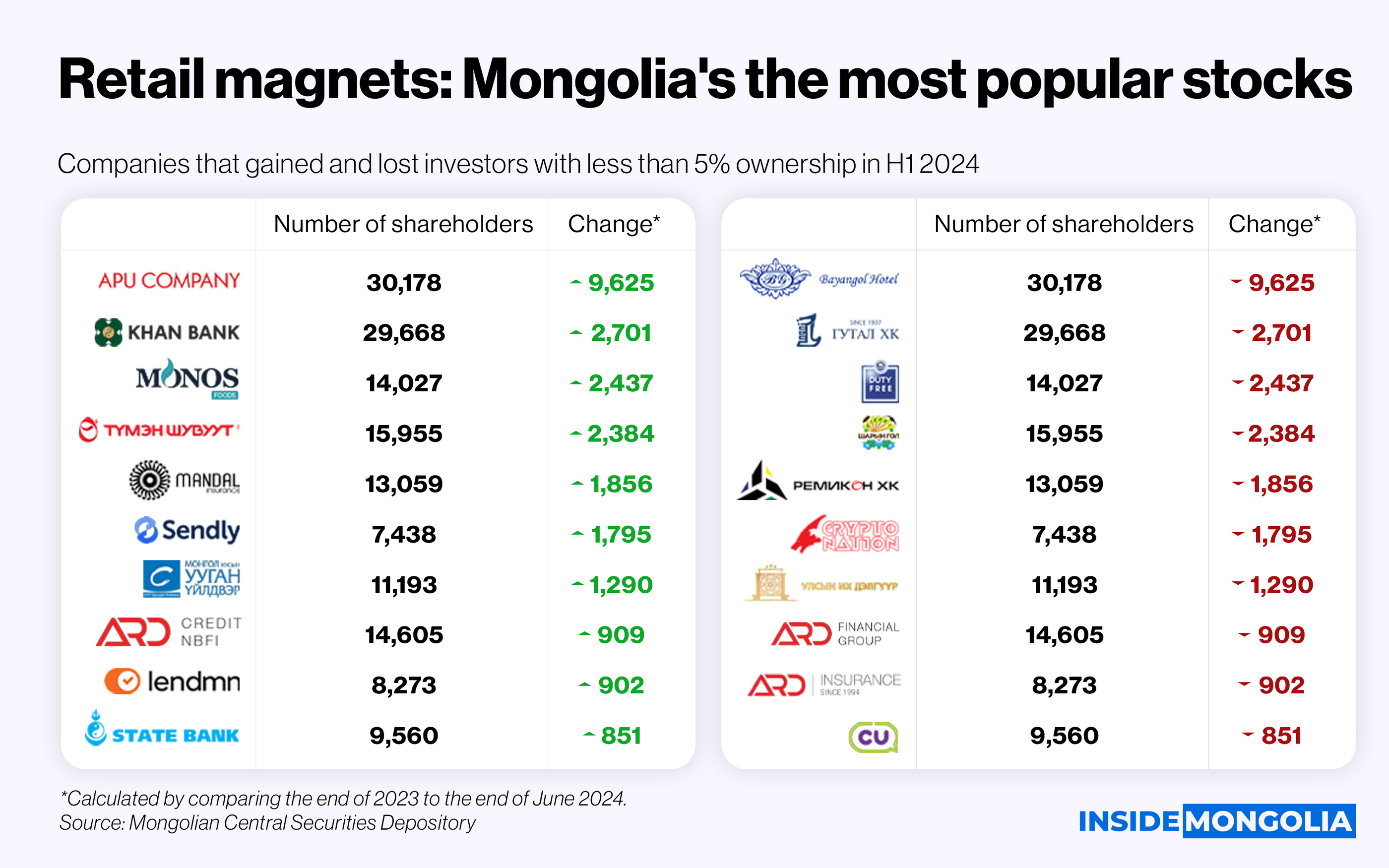

The first half of 2024 witnesses a surge in retail investor activity. The total number of small shareholders, defined as those owning less than 5% of a company, jumped by 26.8 thousand to reach 588.4 thousand.

Interestingly, 92.4% of these new investors flock to companies within the top 20 of the Mongolian Stock Exchange. However, LendMN NBFI (LEND) ranking outside the top 20, also sees a significant increase in small shareholders, propelling it to the 9th position based on this metric.

Finally, A.K.A APU (APU) takes the crown for the most significant increase in small shareholders. The company welcomes a total of 9.6 thousand new small investors, bringing their total to 30.2 thousand. This major shift can be attributed to Shunkhlai Group's decision to distribute APU shares to all its employees at the end of 2023.

Overall… From taming inflation and engaging in strategic partnerships to a thriving banking sector and a growing retail investor base, Mongolia seems poised for a promising year. It will be interesting to see how these developments unfold in the second half and how they translate into tangible benefits for citizens. We look forward to bringing you a full-year wrap-up of Mongolia's 2024 performance to see if the initial momentum continues.

Comment