2023 Wrap: Capital Market

Inside Mongolia

December 25, 2023

December 25, 2023

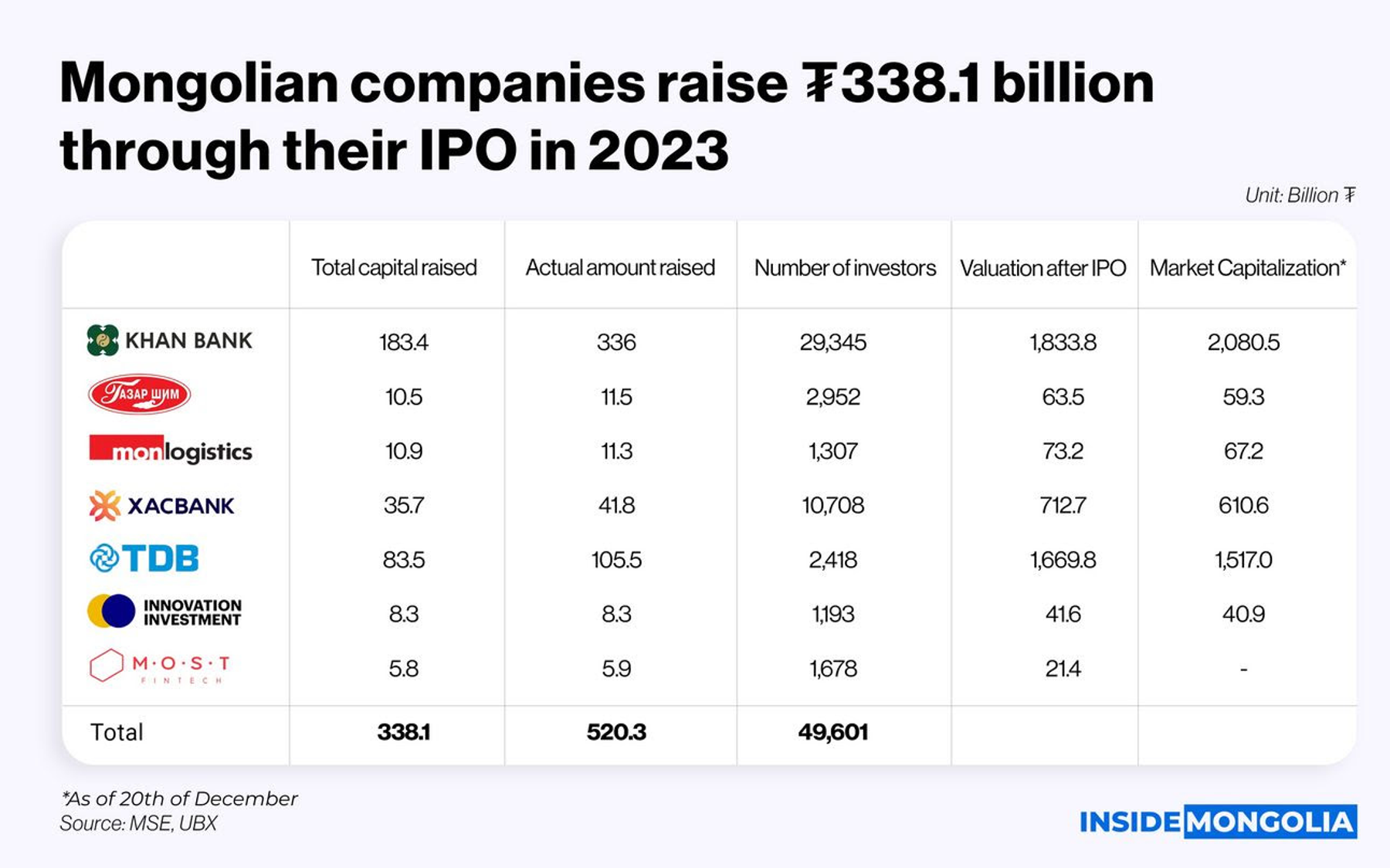

Mongolian 7 companies raised a total of ₮338.1 billion through their IPOs this year. Among those companies are 3 banks, 2 fintechs, 1 logistics company, and 1 food company. Following these IPOs, the Mongolian stock market rose by ₮4.4 trillion and reached ₮10 trillion. A total turnover on the Mongolian Stock Exchange (MSE) reached ₮669 billion, as of November. Let’s dig into the depth,

- Stock trading makes up 72.6% with 50.2% of the primary stock market and the secondary stock market accounting for 22.4%.

- Bond’s primary market trading share of 13.5% while the primary market for asset-backed securities (ABS) constituted 5.2% of the overall market activity.

Aside from the IPOs, Mongolian first exchange-traded fund, Invescore Global Q (INQ) was listed on the Ulaanbaatar Securities Exchange (UBX) at ₮500 per unit. The OTC market’s trading volume reached ₮401.1 billion, as of November, with an outstanding amount of ₮1.3 trillion as of 23rd of December. The average interest rate for OTC market bonds, maturing up to 18 months, stands at 19.7%.

At last, state-owned enterprises will go public in 2024 with a new tax law for foreign investors. The new law which is 1% capital gains tax on foreign investors will be implemented next year.

Comment