Mining Giants' Performance

So far, mining companies are the only firms traded on foreign exchanges from Mongolia. Let’s examine their performance over the past year.

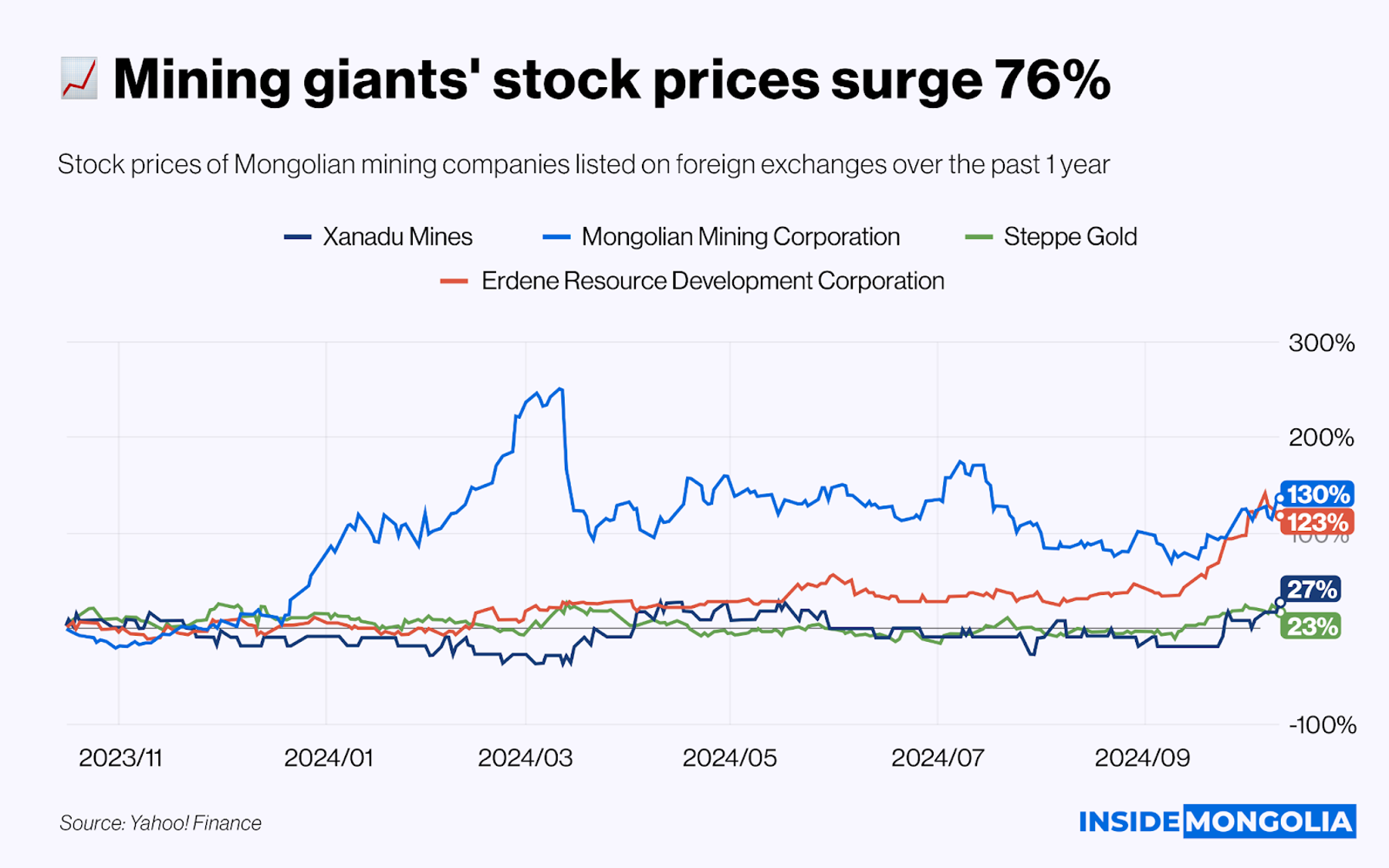

📈 Annual Growth: 76%

Share prices of four companies led by Mongolian Mining Corporation (0975.HK) and Energy Resources, which focus on coking coal, increase by an average of 76% over the past 1 year and 46.2% year-to-date. Among these mining giants, MMC’s shares lead in growth, with the amount of raw coal mined by the company in the third quarter increasing by 23% compared to the previous year, reaching 4.3 million tons.

- 🫨 Rocky Road: Shares of Xanadu Mines (XAM.TO), a co-developer of the Kharmagtai copper-gold project, fall since late November 2023 but rebound since April this year. In addition to rising gold prices, the preliminary feasibility study of the Kharmagatai project indicates that the mine has a lifespan of 29 years, with an average annual production of 75,000 tons of copper and 165,000 ounces of gold.

- 💪 High Growth: The stock price of Erdene Resource Development Corporation (ERD.TO), dual-listed on the Mongolian Stock Exchange (MSE) and the Toronto Stock Exchange, grows by 123% in the last year and 110.3% year-to-date. As of Tuesday, their stock price exceeds its 50-day moving average. $ERDN shares are also actively traded on the MSE.

🌞 The Market Where the Sun Shines the Most

China’s efforts to stabilize its steel production maintain a high demand for coking coal. As a result, coal imports are expected to reach 100 million tons in 2024, and the amount of coal imported from Mongolia in the first 10 months of the year increases by 116% compared to the same period last year. This situation positively impacts Mongolian mining companies.

- 🥇 Gold Boom: Additionally, shares of major players in the gold market gain popularity due to a 1.4 times increase in the price of gold over the past 1 year. In this context, the stock price of Steppe Gold (STGO.TO), which merges with Boroo Gold to become a leader in the Mongolian gold mining industry, rises by 23% in the last 1 year.

Finally, Mongolia’s mining companies listed on foreign stock exchanges continue to progress. However, the MSE needs to attract more mining companies, as those with strategic mines face a pivotal decision due to new legislative requirements. By law, strategic depositors must have at least 10% of their shares publicly traded, encouraging these companies to consider listing on the MSE.

Comment