MSE Insurers’ Q3 Results in Focus

Khulan M.

November 17, 2025

November 17, 2025

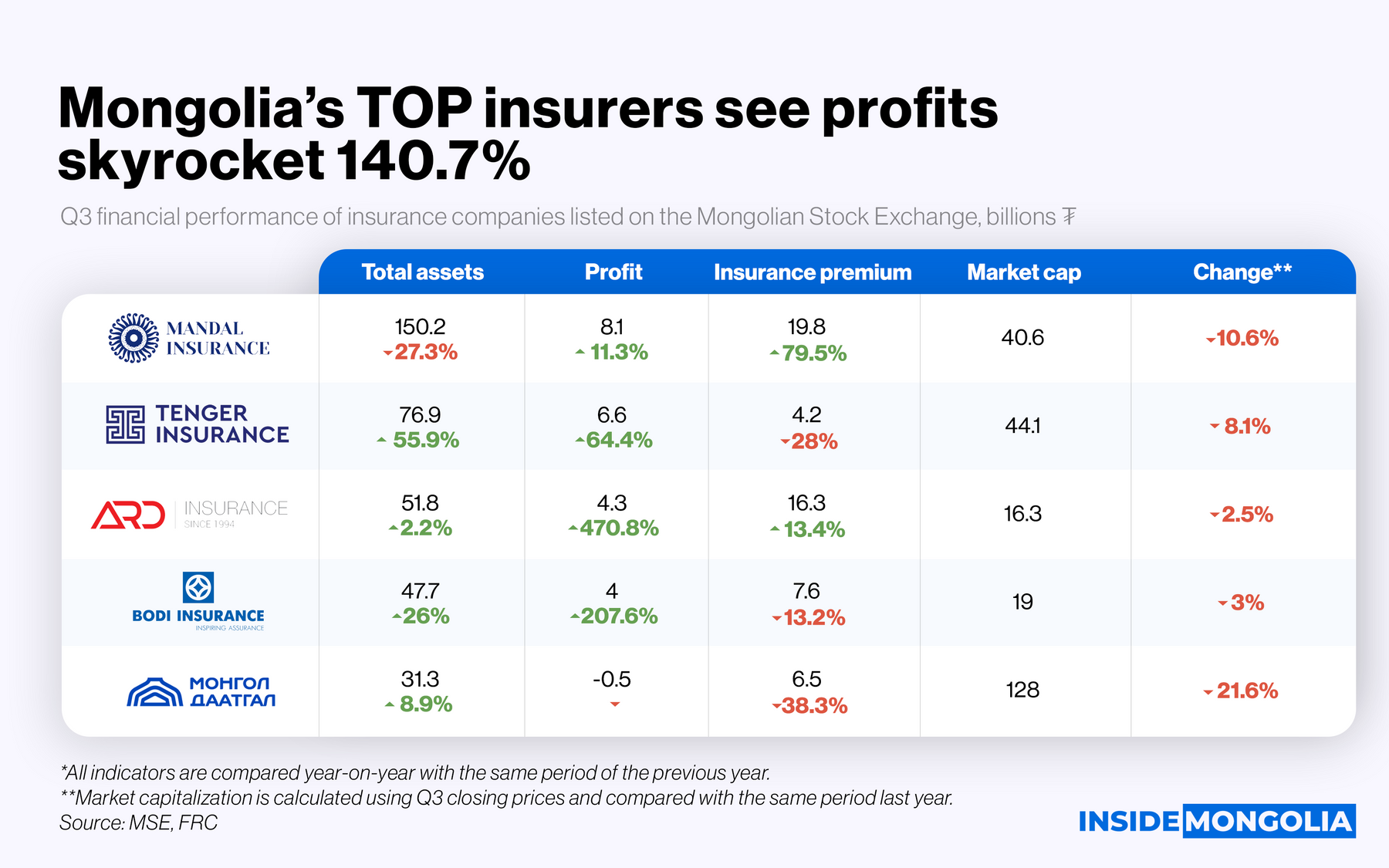

Mongolia’s insurance sector is on a strong recovery path, with profits surging and premiums climbing. The latest results from five publicly listed insurers on the Mongolian Stock Exchange (MSE) provide a clear snapshot of the industry’s performance.

💰 Net profit surges 140.7%

In the third quarter of 2025, the net profit of the five listed insurance JSCs jumped 140.7% to ₮22.4 billion. Mandal Insurance (MNDL) led the pack with a net profit of ₮8.1 billion, while Ard Insurance (AIC) posted the largest growth, with net profit increasing 5.7 times to ₮4.3 billion.

- 💔 Among Us: Among the 5, Mongol Insurance (MDIC) was the only company in the red, reporting a loss of ₮544.3 million. Still, this marks a ₮3.5 billion improvement compared to the same period in 2024.

- 📈 Premium income on the rise: Total premium income climbed 9% year-on-year, reaching ₮236.1 billion. $MNDL, Bodi Insurance (BODI), and Tenger Insurance (TGI) all recorded increases in premium revenue over the same period.

- 📐 Claims remain steady: Insurance claims totaled ₮54.4 billion, up 2.7% from a year ago. Notably, $MDIC posted the largest reduction in claims, down 38.3% to ₮6.5 billion compared to Q3 2024.

📉 Market Capitalization Dips

Despite strong profitability, the sector’s market capitalization fell ₮44.9 billion from last year, settling at ₮248.1 billion. $MDIC remains the leader in market value, but its share price has dropped 21.6% year-on-year and 6.1% since the start of 2025.

Finally… The third-quarter financial metrics of the 5 publicly listed insurers were largely aligned with expectations. All eyes now turn to the full-year 2025 report to see if the sector can maintain its momentum.

Comment