This Article is Out of Date/ September 11, 2023

The 51 securities firms registered in MSE made a profit of ₮5 billion in the first half of the year

Khulan M.

September 11, 2023

September 11, 2023

The 51 securities firms registered in MSE (MSE) made a profit of ₮5 billion so far in the first half of the year.

Red → Green

The total operating income of these securities firms increased by 64.7% compared to the previous year and reached a total of ₮20.4 billion. As a result, the securities firms, which were operating at a loss of ₮2.9 billion at the same time last year, saw a profit of ₮5 billion.

- Mixed: However, only 16 were profitable. while 21 were at a loss, and the rest haven’t reported yet.

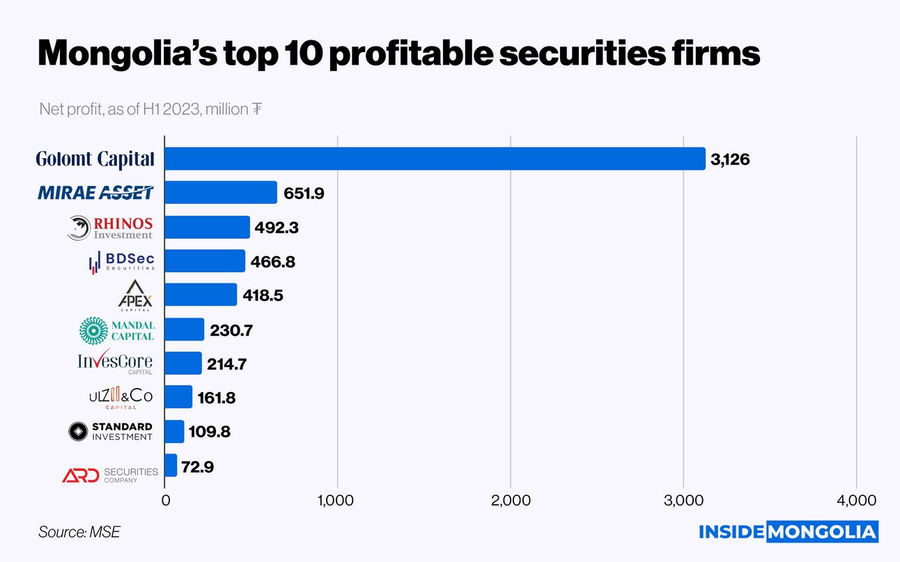

- Top ten: The operating income of the top 10 most profitable securities firms increased by 78.4% from a year ago. As a result, their total profit reached ₮6 billion.

- 52.6%: Golomt Capital’s profit made more than half of the top 10 securities firms' profit pie.

The secret behind the surge

Understandably, the trading volume of all 51 securities firms increased 1.9 times in the first half of the year. Of course, the more you trade, the more you earn. But when it comes to trading, each firm has its tricks.

- Bond lovers: Securities firms such as Golomt Capital and Ulzii & Co Capital dominated the primary bond market while Mandal Capital Markets has done well in the secondary bond market.

- Stonk lovers: BDSec dominated the primary stock market mainly due to the fact that they were the main underwriter of KHAN Bank (KHAN)’s IPO. On the other hand, Investor Capital and Ard Securities are more into the secondary market trading of stocks.

Comment