Mongolia's Economic Outlook: 2027-2028

Khulan M.

March 24, 2025

March 24, 2025

The Ministry of Economy and Development drafts the medium-term fiscal framework based on macroeconomic projections from the Fiscal Stability Council (FSC). Let’s explore the key points from the FSC’s forecast.

🔻 To Grow Anyway: But Deficit Expected

According to the FSC, real GDP growth ranges from 5.4% to 5.7% in 2026-2028. However, the share of budget revenues in GDP stays steady at 35.7%, while expenditures range between 36.7% and 37.7%. In other words, the government approves a balanced budget in 2026, but it expects a budget deficit afterward.

⚡ Interesting Prediction

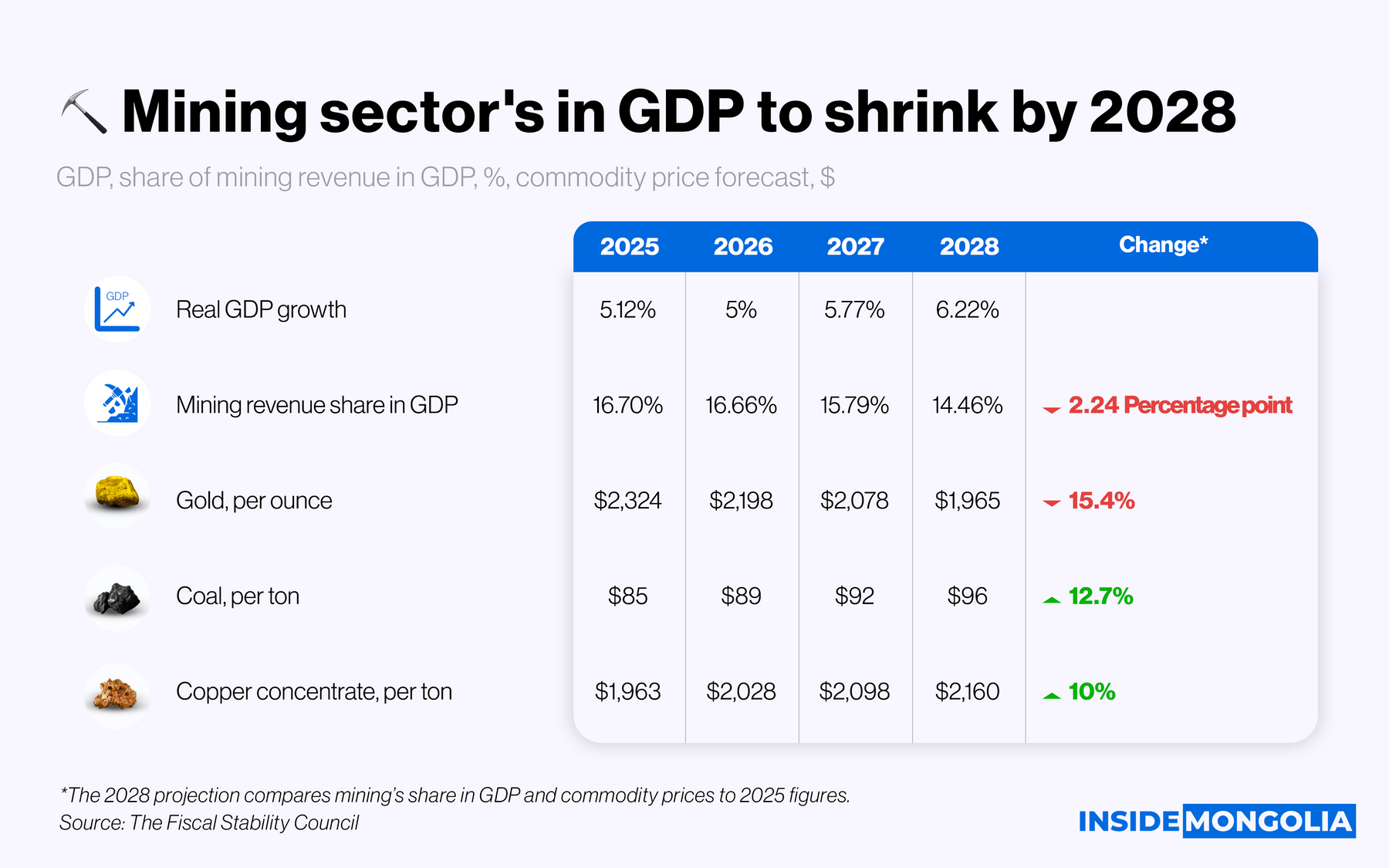

Mining revenues, which are a major source of Mongolia's GDP and budget, contribute 16.7% of GDP in 2025. However, this share decreases by 2.2 percentage points by 2028. The FSC’s commodity price forecast suggests a 5.4% average annual drop in gold prices from 2025 to 2028, while coal prices rise by 4.1%. However, current trends contradict these forecasts, meaning the budget is based on somewhat optimistic assumptions regarding commodity prices.

🎬 Inflation: Just a Trailer

On inflation, the Bank of Mongolia forecasts that electricity price hikes contribute an additional 1.2 percentage points to inflation. As a result, inflation in Ulaanbaatar rises steadily since June 2024, exceeding 10%. Unfortunately, the Bank notes, "Inflation does not reach its peak yet. It continues to rise over the next two quarters and enters double digits," with a projected drop to 8% by 2026.

🤫 Meanwhile: Boost the Foreign Exchange Reserves!

According to the FSC, the balance of payments remains in deficit in 2027-2028. Consequently, foreign exchange reserves stay unchanged. However, if imports rise, reserves cover only 2.8 months of import consumption by 2028. In response, Finance Minister instructs the Erdenes Mongol Union to build up $1 billion in foreign exchange reserves, potentially by increasing coal sales.

In summary, Mongolia’s 2027-2028 budget projections are set. What are your predictions? Share your thoughts HERE.

Comment