Mongolia's First Green Bond on the Vienna Stock Exchange

Khulan M.

November 18, 2024

November 18, 2024

Trade Development Bank (TDB) successfully launches Mongolia’s first Social and Green Bond dedicated to international investors.

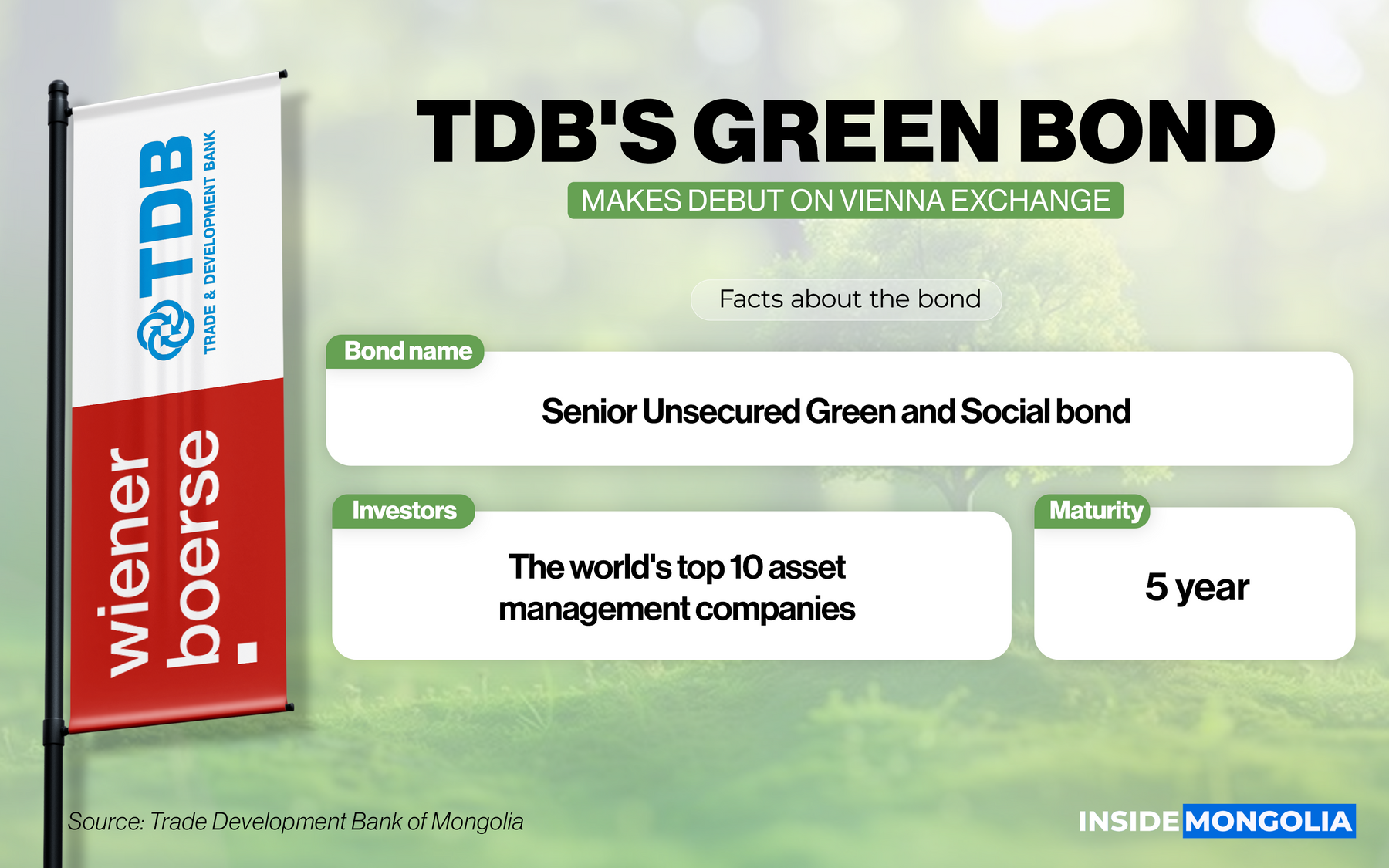

- The bond, a 5-year “Senior Unsecured Green and Social Bond," is listed on the Vienna Stock Exchange in Austria, marking a significant milestone for both TDB and Mongolia’s financial sector.

🤲 Dual purpose

This type of bond addresses critical social challenges such as poverty, education, and health, while also supporting ecological sustainability initiatives, including renewable energy and climate change mitigation. TDB aims to channel $2 billion into sustainable development projects by 2030 as part of its broader strategy to transform into a Green Bank.

🤩 Successful Market Debut

TDB, with its extensive experience in the international bond market, has issued a total of 5 bonds since 2007, raising a total of $1.14 billion. This latest bond issuance highlights the bank’s commitment to supporting green and social projects, attracting $50 million in financing from the global TOP-10 asset management firms, led by BlackRock (BLK) and Vanguard. Notably, the bond features a competitive 9.5% annual interest rate, with interest and principal payments made semi-annually. FYI, the bond was underwritten by Korea Investment & Security Asia (KISA), a major player in global investment.

- 🍰 The funds raised are allocated as follows: 80% ($40 million) goes to green loans for environmental sustainability, while 20% ($10 million) is dedicated to social loans addressing key issues.

- 🆙 Raising Mongolia’s profile: The successful issuance of this bond marks a historic achievement for Mongolia’s banking sector, raising the country’s financial profile on the international stage. It highlights TDB's commitment to integrating ESG factors into its lending practices, solidifying its leadership in sustainable finance in the region.

TDB’s ability to attract significant international investment underscores the growing confidence in Mongolia's financial markets and its commitment to sustainable economic growth. The issuance of the bond signals a promising future for Mongolia’s financial sector, as the country positions itself as an emerging player in the global sustainable finance landscape.

Comment