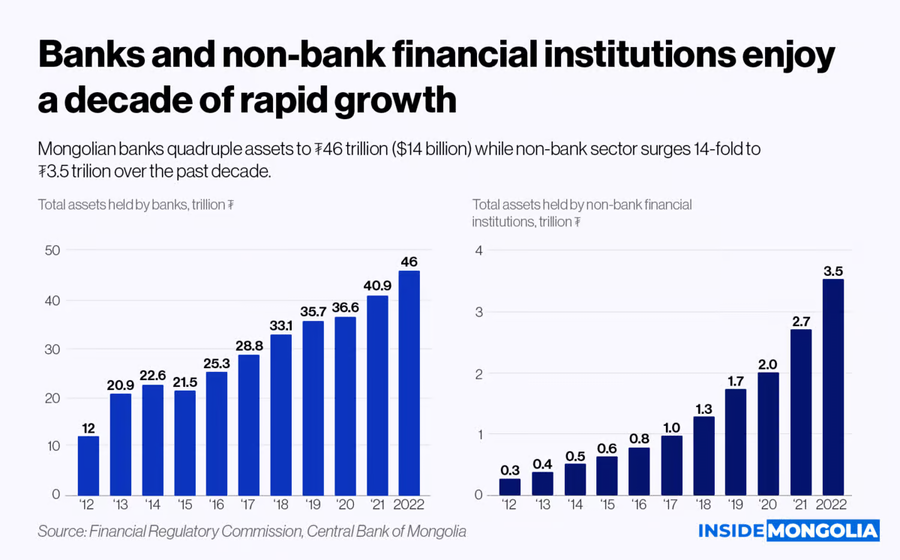

The financial sector enjoyed a decade of rapid growth

May 15, 2023

May 15, 2023

Both banks and non-bank financial institutions (NBFIs) in Mongolia have grown rapidly in the past decade, but NBFIs have outpaced banks in some key metrics.

- Banks: Banks still dominate the market in terms of size and profitability. Their total capital has quadrupled to ₮4.8 trillion, and their net profit has increased five times to ₮1 trillion since 2012. Their net credit to customers has also tripled to ₮20.3 trillion.

- NBFIs: However, NBFIs have expanded faster in relative terms. Their total capital has increased 14-fold to ₮3.4 trillion and their net profit has surged 16.8-fold to ₮300 billion in the same period. Their net loans have jumped 16.7-fold to ₮2.5 trillion, driven by a 5.5-fold rise in electronic loans to ₮1.2 trillion in the past three years.

A comparison of ratios reveals some of the differences between the two sectors.

- Return on assets (ROA): NBFIs have a higher ROA of 9%, compared with 2% for banks. This suggests that NBFIs are more efficient at generating profits from their assets.

- Return on equity (ROE): Banks have a higher ROE of 21%, compared with 14% for NBFIs. This indicates that banks are more effective at using shareholders’ funds to generate profits.

- Net profit margin: NBFIs have a higher net profit margin of 45%, compared with 27% for banks. This implies that NBFIs have lower costs than banks.

The rapid growth of NBFIs reflects their adoption of fintech solutions that have enabled them to reach more customers and offer more services. Banks, meanwhile, have also invested in digital technology, such as neo and digital banks, to compete with NBFIs. The future of the financial sector will depend on how these two types of institutions collaborate and innovate.

Comment