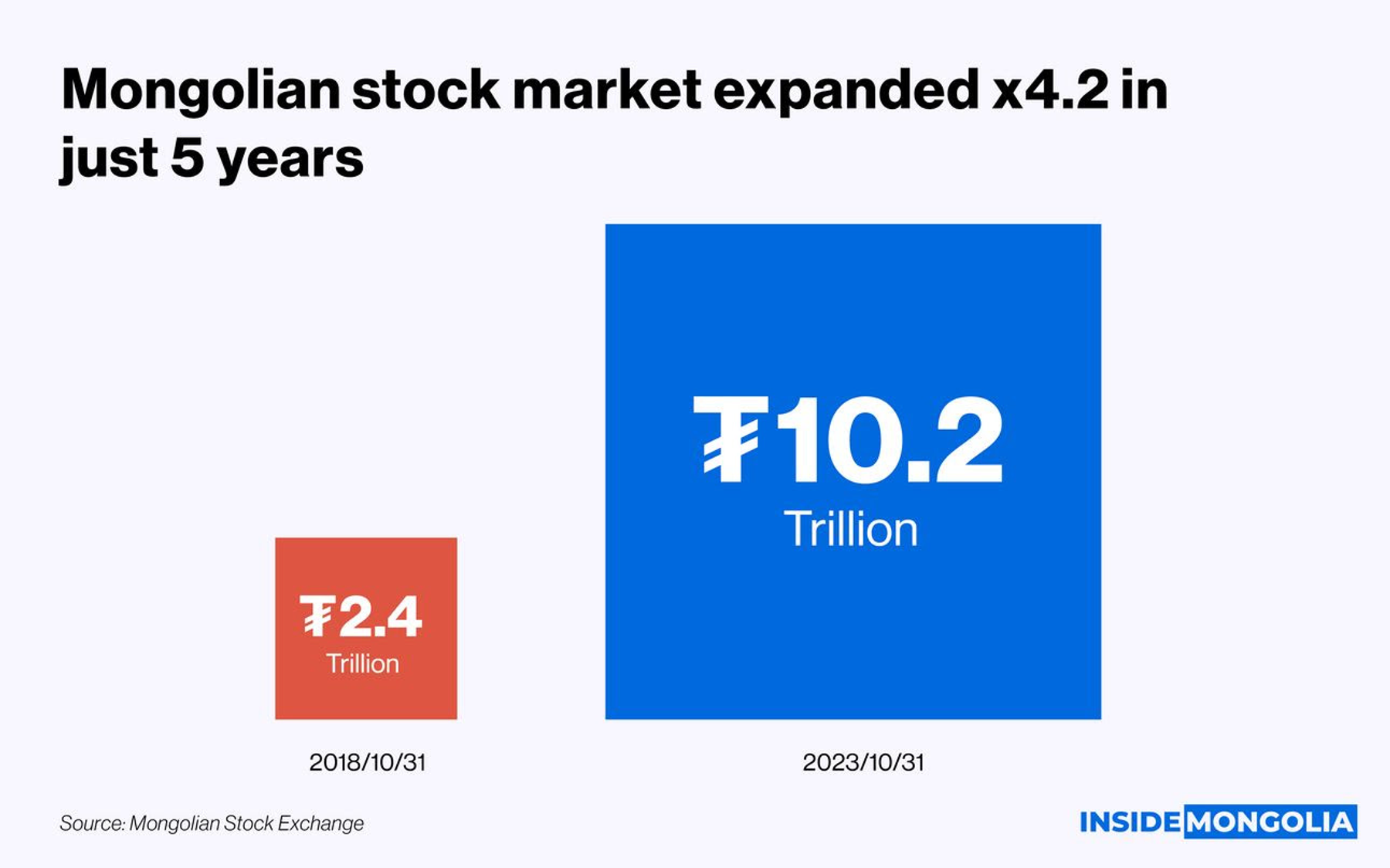

Mongolia's Stock Market Soars 337.9% in 5 Years

Inside Mongolia

November 27, 2023

November 27, 2023

The Grand Bull Awards, which recognize outstanding achievements of the last 5 years of Mongolia's stock market, to hold this Friday. Let’s review the last 5 years of the stock market.

Shining last 5 years

Mongolia's financial sectors witnessed significant growth, with the stock market's capitalization surging by 337.9%. NBFIs assets followed closely, expanding by 207.1%, while insurance, banking, and credit unions recorded growth rates of 56.2%, 54.2%, and 47.8%, respectively from 2018 to Q2 2023. In addition to market expansion, various indicators have demonstrated positive trends, underscoring the resilience of Mongolia's financial sector.

- Investments in the stock market have experienced a notable surge in recent years. The ratio of total stock market value to M2 supply, a key indicator of funds invested in the stock market, has steadily increased from 0.13 in 2018 to 0.31 as of 2023 Q3, reflecting growing investor confidence and participation in the market.

- Value in the economy: As the market grew, the value of traded stocks and the Buffett Indicator also surged. For example, stock trading reached a peak of ₮1.4 trillion in 2021, while the Buffett Indicator, representing the ratio of total stock market value to GDP, has been steadily increasing and reached 17% as of Q3 2023.

Also, Since the inaugural security listing on the OTC market in September 2021, a total of ₮2.1 trillion in securities have been listed, resulting in ₮1.5 trillion raised on the OTC market as of H1 2023.

- Future: The Mongolian Stock Exchange (MSE) secured its classification as a "frontier market" in the FTSE as of September this year. This significant recognition positions the Mongolian stock market and its companies on the global stage, poised to attract foreign strategic investors in the coming years.

At last, in the span of 5 years, Mongolia's stock market, which experienced stagnation for the past three decades, has undergone rapid and impressive development. As a young frontier market, Mongolia's stock market has not only grown remarkably in the recent years but also holds the potential for even more accelerated growth in the future.

Comment