This Article is Out of Date/ June 4, 2023

Bond trading

June 4, 2023

June 4, 2023

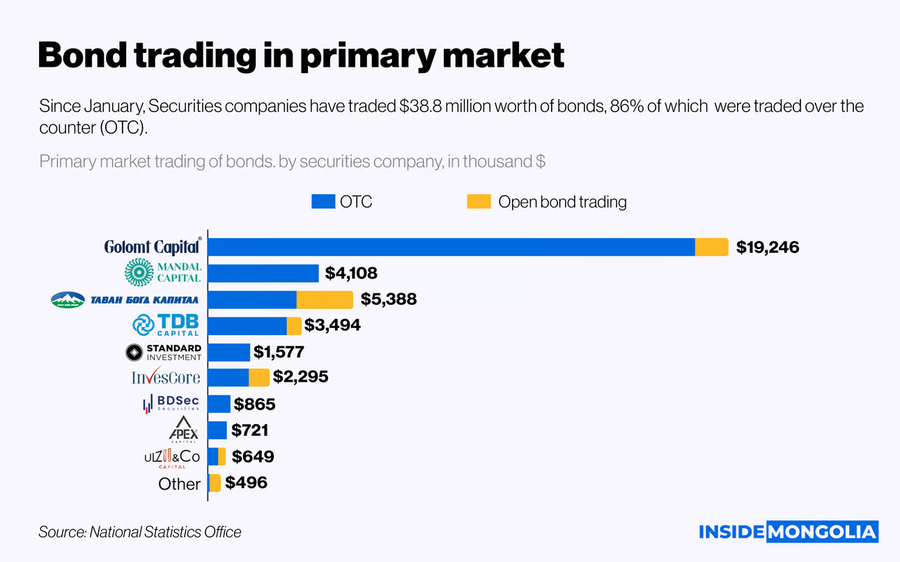

Securities companies in Mongolia have traded bonds worth $38.8 million (₮134.7 billion) in the primary market since January, with Golomt Capital leading the pack.

Main player

Golomt Capital, which has also introduced the country’s first open, closed, insured and bank-guaranteed bonds, accounted for 49.6% of the primary market trading. The company has raised $72 million from its bond issuance and paid back $30.2 million to its customers, who have earned $4.6 million in interest over the past year.

Key insights

- Most of the bond trading in the primary market, or 86.3%, took place in the over-the-counter market, while the remaining 13.7% was done through open bond trading.

- In the open market, securities companies traded Sendly and Invescore bonds worth $5.3 million, with Tavan Bogd Capital and Golomt Capital handling 38.8% and 23.5% of the trading respectively.

- In the over-the-counter market, bonds worth $33.5 million were traded, involving companies from the oil, mining, construction and banking sectors.

The bond market in Mongolia is open to all investors who want to diversify their portfolio and earn stable returns.

Comment