Investment Funds Struggle: Major Discounts VS Growth

Khulan M.

April 21, 2025

April 21, 2025

6 years ago, the National Privatization Fund (XOC) was established, followed by the Mandal Future Growth Fund (MFG) in 2021, with the slogan “Let’s be the owners of banks.” So, where do we stand today?

🐢 Quiet, but Growing

When these investment funds were first introduced, they generated significant buzz in the stock market. $MFG attracts ₮50 billion, while $XOC garners ₮5 billion. Although both funds remain relatively quiet, their 2024 financial statements are now published on the Mongolian Stock Exchange (MSE). Total assets for both funds grow by an average of 11.9%. However, the National Privatization Fund's asset growth rate lags significantly behind that of $MFG, at 2.8 times lower.

- 📊 $MFG +47.1%: The Mandal Future Growth Fund reports a 47.1% year-on-year increase in net profit, reaching ₮8.4 billion. This surge is driven by a 1.9-fold increase in interest income and a 2.1-fold rise in dividend income. As a result, earnings per share rise to ₮167.8.

- ⤴️ $XOC From Loss to Profit: In contrast, while the National Privatization Fund incurs a loss of ₮793 million in 2023, it turns a profit of ₮379.6 million in 2024. The increase in dividend income and gains from investment sales plays a key role in this turnaround.

🫸🏻 Hold On

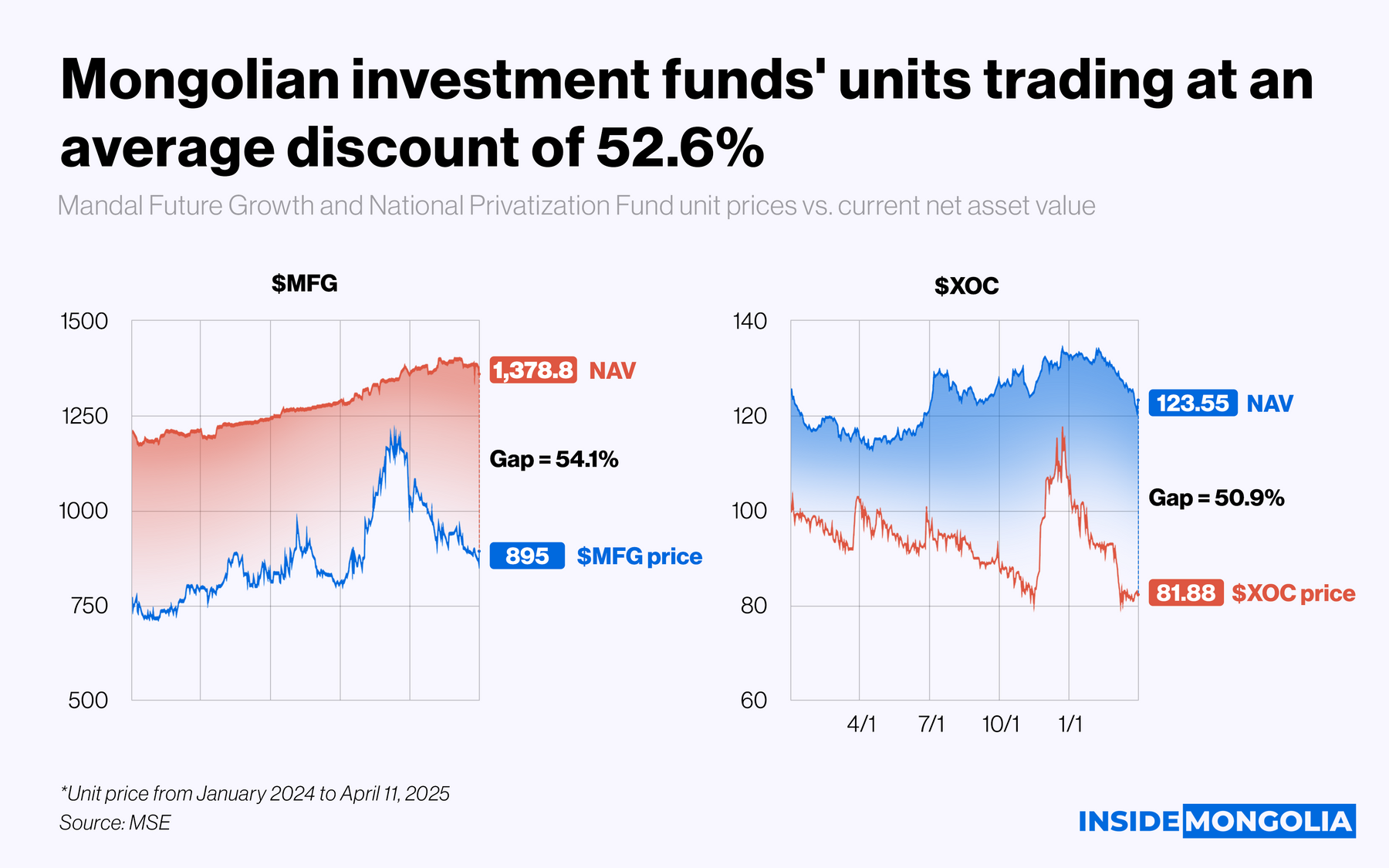

However, the outlook is less favorable regarding unit prices. While investment fund units are traded on the exchange, their current net asset value (NAV) is also calculated. Ideally, these 2 figures align closely, but a significant discrepancy exists. As of April 11, both $XOC and $MFG trade at over a 50% discount to their NAV. $MFG traded at a more modest 31% discount 2 years ago.

🤔 Reason for the Cold Shoulder

This large discount suggests that investors lack confidence in the funds’ prospects or are skeptical of their management and strategy. Additionally, issues with portfolio valuation and liquidity raise concerns.

Finally, unless these funds improve transparency and align with their original investment strategies, their unit prices are likely to remain significantly below their intrinsic value and NAV, with limited potential for recovery.

Comment