Mongolia’s Hotel Sector Keeps Expanding

Khulan M.

January 26, 2026

January 26, 2026

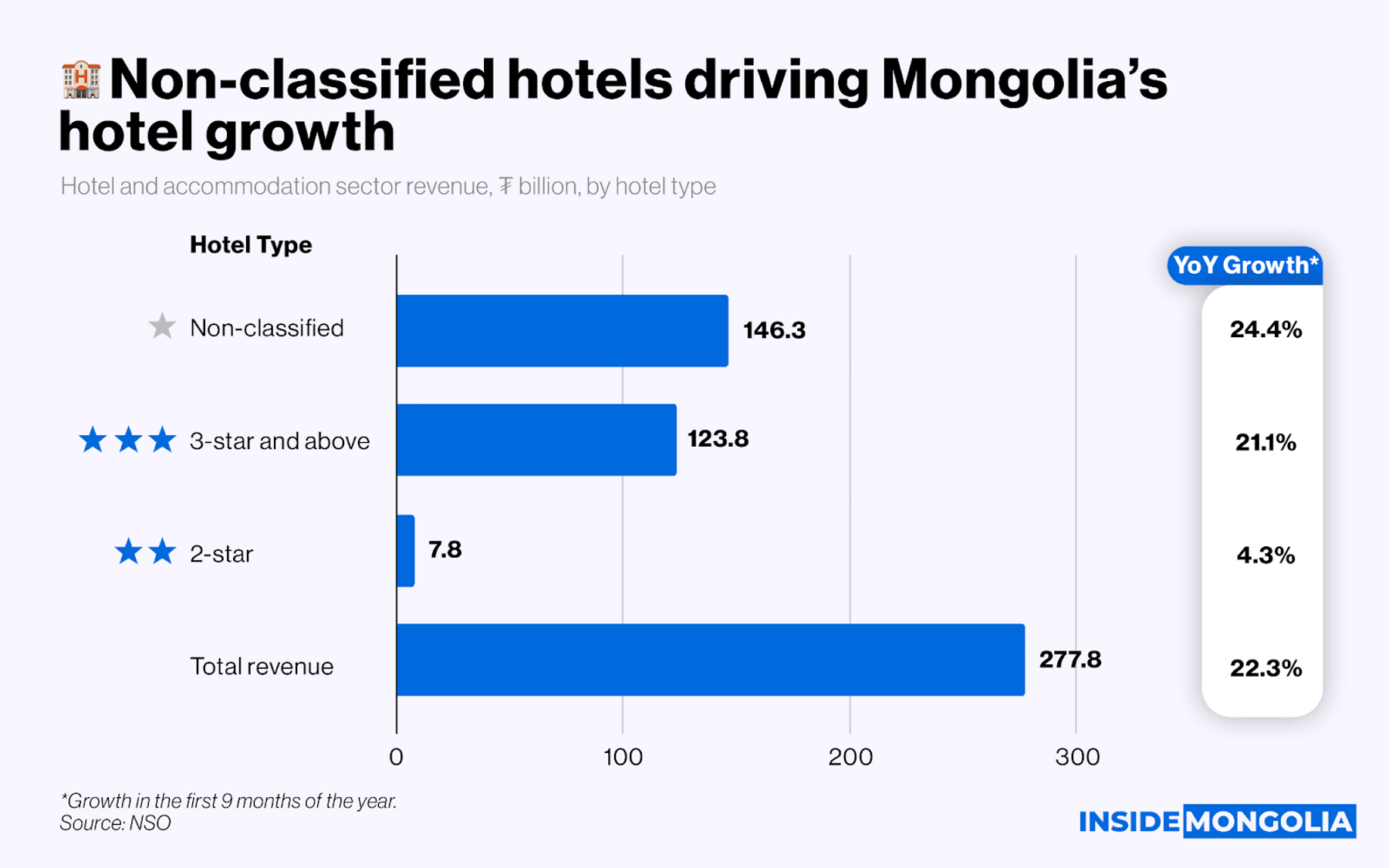

Mongolia’s hotel and accommodation sector continues to grow, with revenue rising 22.3% year-on-year to ₮277.8 billion in the first nine months of 2025.

📈 Record Growth Over 3 Years

Total sector revenue increased from ₮208.3 billion in 2022 to ₮320.9 billion in 2024, representing a cumulative growth of 54% over three years. Moreover, over 2022–2024, the sector recorded an average annual growth rate of approximately 24%, signaling sustained momentum rather than a one-off post-pandemic rebound.

🛏️ Non-Classified Hotels Drive Growth

The sector’s expansion has been driven overwhelmingly by non-classified hotels, which now generate the largest share of accommodation revenue. Specifically, non-classified hotel revenue rose 58.5% to ₮167.2 billion in 2024 over 3 years. Additionally, in the first 9 months of 2025, they generated ₮146.3 billion, nearly matching 2022’s full-year total. This growth is fueled by domestic travelers, longer urban stays, and flexible lodging, rather than new high-end capacity.

- ⭐ Premium Hotels Grow Slower: In contrast, 3-star and above hotels rose from ₮95.3 billion to ₮143.7 billion from 2022 to 2024, with ₮123.8 billion in early 2025. While expansion continues, it remains constrained by capacity limits and higher operating costs.

- ⚠️ 2-Star Hotels Lag: Meanwhile, two-star hotels hover around ₮10 billion annually, squeezed between low-cost options and premium brands, raising concerns about their long-term competitiveness.

🏚️ Capacity Constraints

Despite rising revenues, Mongolia’s hotel sector faces structural capacity limits, especially outside peak summer months. Nationwide, there are 492 hotels, 486 guesthouses, and 922 tourist camps, offering roughly 35,560 bed-nights. However, seasonality reduces supply: of 145 winter-listed camps, only 55 operate, providing just 3,500 bed-nights when demand is concentrated in cities.

Overall… Overall, Ulaanbaatar hosts international 4- and 5-star hotels, including Shangri-La, Kempinski, Best Western, Novotel, and Pullman, yet room shortages persist during peak months, June–September, underscoring the ongoing gap between supply and high-end demand.

Comment