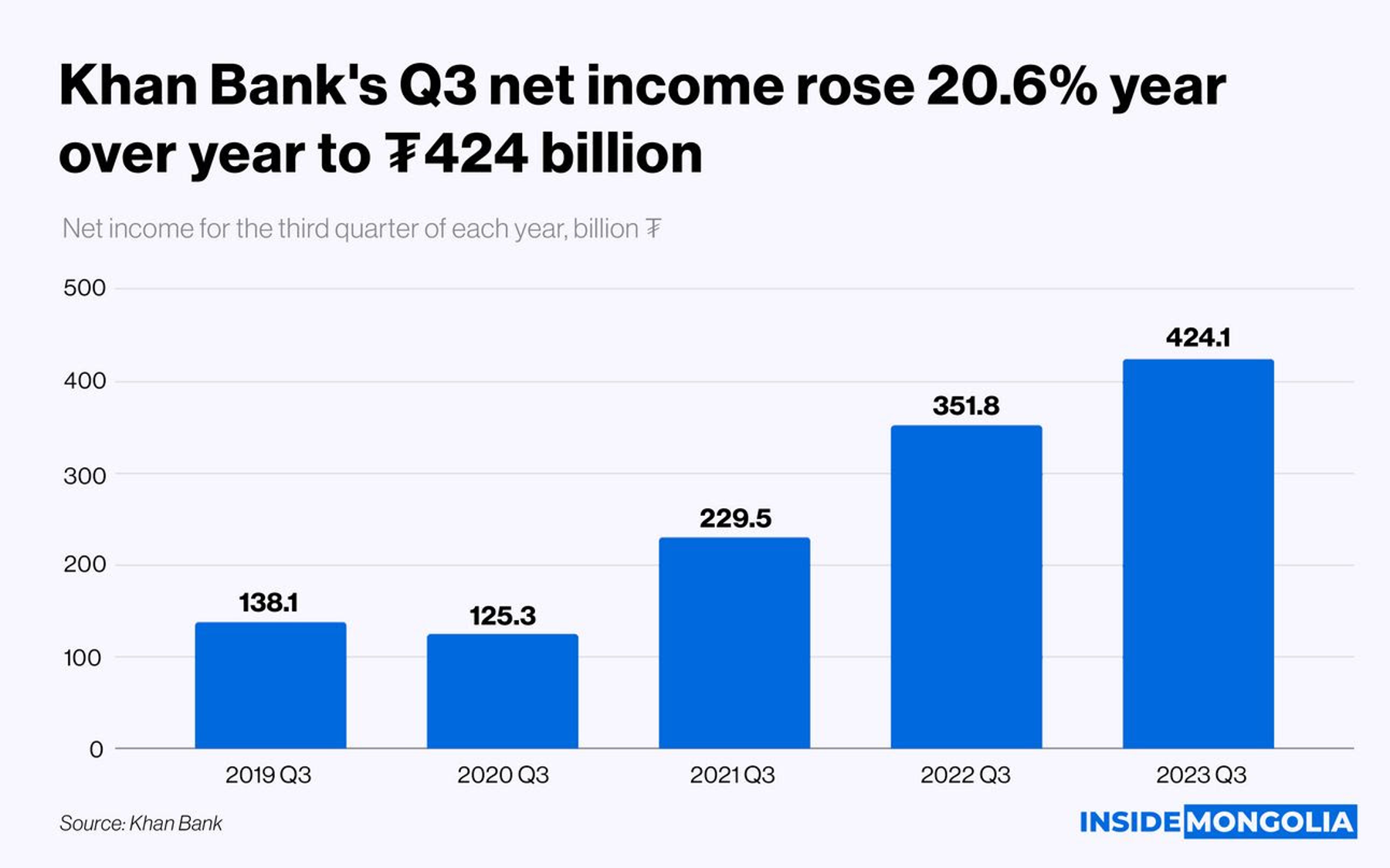

Khan Bank reports 20.6% YoY net income increase in Q3 2023

Inside Mongolia

October 23, 2023

October 23, 2023

Khan Bank (KHAN) reported net income rose 20.6% YoY reaching ₮424 billion as of Q3 2023. How?

- Big numbers: net loans increased by 15.8%, amounting to ₮8.7 trillion, while total assets rose by 22%, reaching ₮16.1 trillion. Current accounts also increased by 20%, totaling ₮4.3 trillion, and deposits expanded by 16.8% to ₮7 trillion.

The bank's interest income rose by 48.5% to reach ₮1.5 trillion. This growth is affected by interest income from securities, which increased 1.9 fold, totaling ₮0.3 trillion. However, interest expenses climbed by 90.1% to ₮0.7 trillion, primarily due to macro influences.

- Policy interest rate: The Bank of Mongolia raised its policy interest rate from 6% at the start of 2022 to the current 13% through 6 successive increments. Consequently, the interest rate on new deposits across the banking sector increased by an average of 3.3 percent points, significantly affecting interest expenses.

- A surprise: The no-interest clause on demand deposits and current accounts due to the ongoing COVID-19 pandemic has expired this year. As a result, the bank incurred interest expenses of ₮7 billion on current accounts this year.

From the stock market perspective,

- Dividend distribution: The bank has announced in a dividend distribution policy that the bank will distribute more than 40% of the company's net profit after tax in the form of dividends. Assuming a distribution range of 40% to 100% of the profit as of Q3, investors can expect a dividend yield ranging from 8% to 20% at the current price.

- Ratios: The P/E ratio stands at 5, the P/B ratio is 1.1 while ROE stands at 21.8% as of Q3 of 2023.

In conclusion, Khan Bank, a prominent player in the banking industry and the stock market, closed Q3 with an excellent performance.

Comment